Expansion of E-commerce Platforms

The probiotics market in Japan is experiencing a transformation due to the expansion of e-commerce platforms. With the increasing penetration of the internet and mobile devices, consumers are increasingly turning to online shopping for their health products. This shift is particularly relevant for probiotics, as consumers seek convenience and a wider variety of options. E-commerce sales of health supplements, including probiotics, have shown a remarkable growth trajectory, with estimates suggesting a growth rate of around 15% annually. This trend not only facilitates access to probiotic products but also allows manufacturers to reach a broader audience. The rise of e-commerce is likely to play a pivotal role in shaping the future dynamics of the probiotics market in Japan.

Rising Popularity of Functional Foods

In Japan, the probiotics market is significantly influenced by the rising popularity of functional foods. Consumers are increasingly inclined towards foods that provide health benefits beyond basic nutrition. This shift is reflected in the growing sales of probiotic-rich products, which are perceived as beneficial for overall health. Data suggests that the functional food sector in Japan is projected to reach a market value of approximately $30 billion by 2026, with probiotics playing a crucial role in this growth. The integration of probiotics into everyday food items, such as dairy products and snacks, is becoming more prevalent, thereby expanding the consumer base. This trend indicates a robust opportunity for manufacturers to innovate and introduce new probiotic formulations, further driving the growth of the probiotics market.

Government Support for Health Initiatives

The Japanese government actively promotes health initiatives that encourage the consumption of probiotics, thereby positively impacting the probiotics market. Various health campaigns and educational programs aim to raise awareness about the benefits of probiotics in maintaining gut health and preventing diseases. For instance, the Ministry of Health, Labour and Welfare has been known to endorse dietary guidelines that include probiotics as part of a balanced diet. This governmental support not only enhances consumer trust but also stimulates market growth. The probiotics market is likely to benefit from these initiatives, as they encourage both manufacturers and consumers to prioritize health and wellness. Consequently, this driver may lead to an increase in the availability and variety of probiotic products in the market.

Growing Interest in Preventive Healthcare

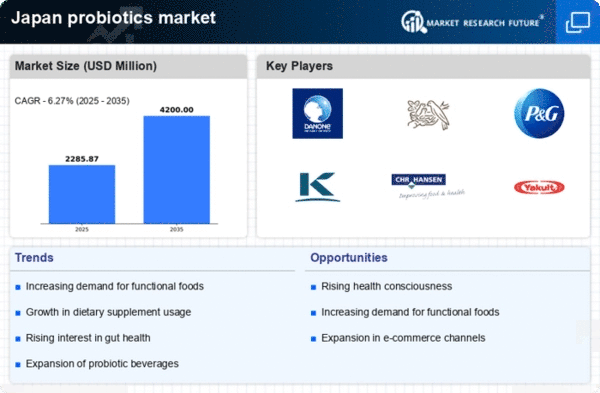

There is a discernible shift towards preventive healthcare in Japan, which is significantly influencing the probiotics market. Consumers are increasingly adopting proactive measures to maintain their health, rather than solely relying on treatments for existing conditions. This trend is reflected in the rising consumption of probiotics, which are perceived as a preventive measure for various health issues, including digestive disorders and immune system support. Market analysis indicates that the preventive healthcare segment is expected to grow at a CAGR of approximately 7% in the coming years. As consumers become more health-conscious, the demand for probiotic products that promote overall wellness is likely to increase, thereby driving the growth of the probiotics market in Japan.

Increasing Demand for Digestive Health Solutions

The probiotics market in Japan experiences a notable surge in demand for products that promote digestive health. This trend is largely driven by a growing awareness among consumers regarding the importance of gut health. Research indicates that approximately 70% of Japanese consumers actively seek out functional foods that support digestive wellness. As a result, manufacturers are increasingly focusing on developing probiotic products that cater to this demand, including yogurts, supplements, and fortified beverages. The probiotics market is thus witnessing a diversification of offerings aimed at enhancing digestive health, which is expected to contribute to a compound annual growth rate (CAGR) of around 8% over the next five years. This increasing consumer interest in digestive health solutions is likely to shape the future landscape of the probiotics market in Japan.