Rising Healthcare Expenditure

The orthopedic implant market in Japan is also being propelled by rising healthcare expenditure, which reflects the government's commitment to improving health services. Increased funding for hospitals and clinics allows for the procurement of advanced orthopedic implants and technologies. As healthcare spending continues to rise, estimated to reach approximately 10% of GDP by 2026, the orthopedic implant market is poised for growth. This financial support enables healthcare facilities to invest in state-of-the-art surgical equipment and training, ultimately enhancing patient care and outcomes. Consequently, the market is likely to expand as more patients gain access to necessary orthopedic procedures.

Government Initiatives and Funding

Government initiatives aimed at improving healthcare infrastructure and funding for orthopedic procedures are playing a crucial role in the growth of the orthopedic implant market. In Japan, the government has implemented various programs to subsidize medical costs associated with orthopedic surgeries, making them more accessible to the population. This support is particularly vital for the aging demographic, which requires more frequent surgical interventions. The orthopedic implant market stands to gain from these initiatives, as they not only increase patient access but also encourage healthcare providers to adopt advanced implant technologies. As a result, the market is likely to see a surge in demand for high-quality implants.

Increasing Awareness of Joint Health

There is a growing awareness among the Japanese population regarding the importance of joint health and the role of orthopedic implants in maintaining mobility. Educational campaigns and health initiatives are promoting early diagnosis and treatment of orthopedic conditions, leading to an increase in elective surgeries. This heightened awareness is expected to drive the orthopedic implant market, as more individuals seek surgical options to alleviate pain and improve quality of life. The orthopedic implant market is thus likely to benefit from this trend, as patients become more proactive in managing their orthopedic health and exploring available treatment options.

Rising Incidence of Orthopedic Disorders

The orthopedic implant market in Japan is experiencing growth due to the increasing prevalence of orthopedic disorders such as osteoarthritis and fractures. As the population ages, the incidence of these conditions rises, leading to a higher demand for surgical interventions. According to recent data, approximately 30% of the elderly population in Japan suffers from some form of arthritis, necessitating the use of implants for joint replacement surgeries. This trend indicates a robust market potential, as healthcare providers seek advanced solutions to address these challenges. Furthermore, the orthopedic implant market is likely to benefit from innovations in implant materials and designs that enhance patient outcomes and recovery times.

Technological Innovations in Implant Design

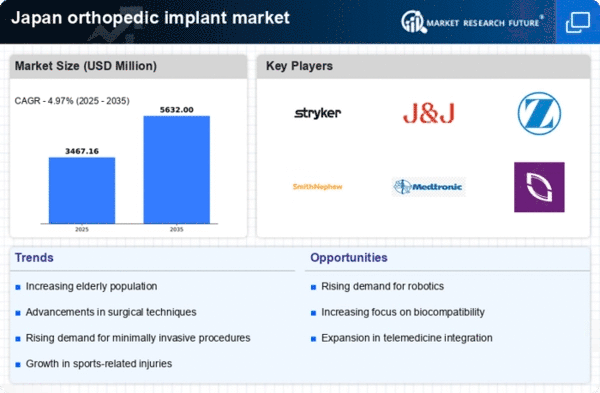

The orthopedic implant market is significantly influenced by ongoing technological innovations that enhance the functionality and effectiveness of implants. Advanced materials, such as bioactive ceramics and smart polymers, are being developed to improve biocompatibility and longevity of implants. Additionally, minimally invasive surgical techniques are gaining traction, reducing recovery times and hospital stays. The market is projected to grow at a CAGR of around 6% over the next five years, driven by these advancements. The orthopedic implant market is thus positioned to evolve rapidly, as manufacturers invest in research and development to create next-generation implants that meet the needs of both surgeons and patients.