Rising Healthcare Expenditure

The increasing healthcare expenditure in Japan is a significant driver for the ophthalmic drugs market. As the population ages and the prevalence of chronic eye conditions rises, healthcare spending on ophthalmic treatments is expected to grow. In 2025, healthcare expenditure in Japan is projected to reach approximately ¥50 trillion, with a notable portion allocated to eye care. This financial commitment reflects the prioritization of eye health within the broader healthcare system. Additionally, the willingness of patients to invest in advanced treatments further fuels market demand. As healthcare budgets expand, the ophthalmic drugs market is likely to benefit from increased funding for research, development, and the availability of innovative therapies, ultimately enhancing patient outcomes.

Growing Awareness of Eye Health

The growing awareness of eye health among the Japanese population is a vital driver for the ophthalmic drugs market. Public health campaigns and educational initiatives have significantly increased knowledge regarding the importance of regular eye check-ups and early intervention for eye diseases. This heightened awareness encourages individuals to seek medical advice and treatment, leading to an uptick in prescriptions for ophthalmic drugs. Moreover, the integration of eye health education into school curriculums and community programs fosters a culture of proactive eye care. As more people recognize the impact of eye health on overall well-being, the demand for effective ophthalmic treatments is likely to rise, thereby propelling the growth of the ophthalmic drugs market.

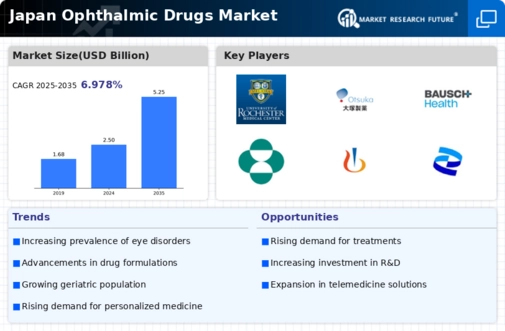

Advancements in Drug Formulations

Innovations in drug formulations are significantly influencing the ophthalmic drugs market. The introduction of novel delivery systems, such as sustained-release formulations and nanotechnology-based products, enhances the efficacy and safety of ophthalmic medications. For instance, the development of eye drops that provide prolonged therapeutic effects reduces the frequency of administration, improving patient compliance. Additionally, the emergence of biologics and gene therapies offers new avenues for treating previously challenging conditions. The Japanese pharmaceutical industry is actively investing in research and development to create these advanced formulations, which could potentially lead to a surge in market growth. As a result, the ophthalmic drugs market is expected to witness a transformation, driven by these technological advancements that promise better outcomes for patients.

Government Initiatives and Support

Government initiatives aimed at improving healthcare access and affordability are pivotal for the ophthalmic drugs market. In Japan, the government has implemented various policies to enhance the availability of essential medications, including ophthalmic drugs. Programs that subsidize the cost of treatments and promote research into eye diseases are likely to stimulate market growth. Furthermore, the Japanese Ministry of Health, Labour and Welfare has been actively encouraging collaborations between public and private sectors to foster innovation in drug development. This supportive regulatory environment not only facilitates the introduction of new ophthalmic drugs but also ensures that existing treatments remain accessible to patients. Consequently, the ophthalmic drugs market is poised for expansion, bolstered by these proactive government measures.

Increasing Prevalence of Eye Diseases

The rising incidence of eye diseases in Japan is a crucial driver for the ophthalmic drugs market. Conditions such as glaucoma, diabetic retinopathy, and age-related macular degeneration are becoming more prevalent, particularly among the aging population. According to recent health statistics, approximately 3.5 million individuals in Japan are affected by glaucoma alone. This growing patient base necessitates the development and availability of effective ophthalmic drugs, thereby propelling market growth. Furthermore, the increasing awareness of eye health and the importance of early diagnosis contribute to the demand for innovative treatment options. As healthcare providers emphasize the need for regular eye examinations, the ophthalmic drugs market is likely to expand, catering to the needs of a larger segment of the population suffering from various eye disorders.