Rising Disposable Income

In Japan, the manuka honey market is positively influenced by the rising disposable income among consumers. As individuals experience an increase in their financial capacity, they are more inclined to invest in premium health products, including manuka honey. Recent statistics indicate that the average disposable income in Japan has risen by approximately 5% over the past year, allowing consumers to prioritize quality over cost. This trend suggests that the manuka honey market could see a significant uptick in sales as consumers opt for higher-priced, high-quality products. The willingness to spend on health-enhancing products may also reflect a broader lifestyle shift towards wellness and self-care, further solidifying the market's growth trajectory.

Expansion of Retail Channels

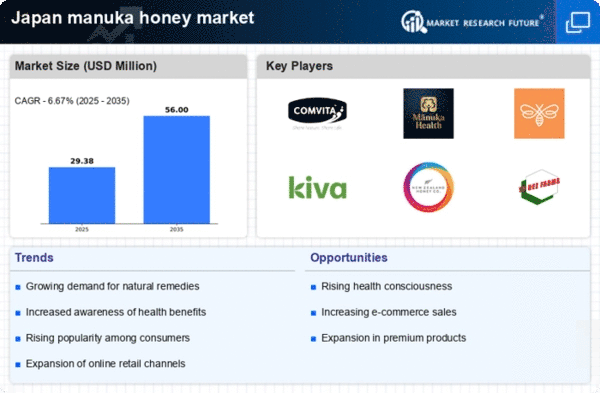

The manuka honey market in Japan is benefiting from the expansion of retail channels, which enhances product accessibility for consumers. Traditional brick-and-mortar stores, alongside online platforms, are increasingly stocking manuka honey, catering to the diverse shopping preferences of Japanese consumers. Recent data indicates that e-commerce sales in the food sector have surged by 20% in the past year, reflecting a shift in purchasing behavior. This expansion of retail channels suggests that the manuka honey market could experience increased visibility and sales as consumers find it easier to access these products. The combination of physical and digital retail strategies may play a crucial role in driving market growth in the coming years.

Growing Interest in Functional Foods

The manuka honey market in Japan is experiencing a transformation driven by the increasing interest in functional foods. Consumers are becoming more discerning about the nutritional value of their food choices, seeking products that offer health benefits beyond basic nutrition. Manuka honey, known for its unique properties, fits well within this trend. Recent market analysis suggests that the functional food sector in Japan is projected to grow by 10% annually, with manuka honey positioned as a key player. This growing awareness of functional foods indicates that the manuka honey market may continue to thrive as consumers actively seek out products that contribute to their overall health and well-being.

Emphasis on Quality and Certification

In Japan, the manuka honey market is significantly influenced by the emphasis on quality and certification. Consumers are becoming increasingly aware of the importance of product authenticity and are seeking certified manuka honey to ensure they are purchasing genuine products. The presence of certification standards, such as UMF (Unique Manuka Factor), plays a crucial role in building consumer trust. Recent surveys indicate that approximately 70% of consumers prefer certified products, which may drive demand for high-quality manuka honey. This focus on quality assurance suggests that the manuka honey market could see a shift towards premium offerings, as consumers prioritize authenticity and reliability in their health-related purchases.

Increasing Demand for Natural Remedies

The manuka honey market in Japan experiences a notable surge in demand as consumers increasingly gravitate towards natural remedies. This trend is driven by a growing awareness of the health benefits associated with manuka honey, particularly its antibacterial properties. According to recent data, the market for natural health products in Japan has expanded by approximately 15% annually, indicating a robust interest in alternative health solutions. As consumers seek to enhance their wellness through natural means, the manuka honey market stands to benefit significantly. This shift towards natural remedies is not merely a passing trend; it reflects a deeper cultural inclination towards holistic health practices, which may continue to shape consumer preferences in the foreseeable future.