Rising Health Consciousness

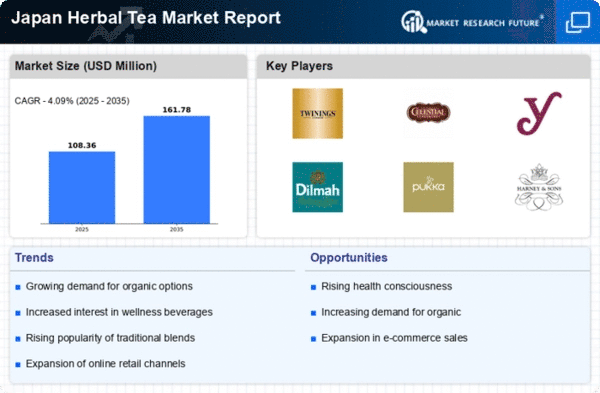

The increasing awareness of health and wellness among consumers in Japan appears to be a primary driver for the herbal tea market. As individuals seek natural alternatives to conventional beverages, herbal teas are gaining traction due to their perceived health benefits. According to recent data, the herbal tea market in Japan is projected to grow at a CAGR of approximately 8% over the next five years. This growth is likely fueled by the rising demand for products that promote relaxation, digestion, and overall well-being. Furthermore, the shift towards preventive healthcare is encouraging consumers to incorporate herbal teas into their daily routines, thereby enhancing the market's appeal. The herbal tea market is thus positioned to benefit from this trend, as more consumers prioritize their health and seek out herbal options.

Innovative Product Offerings

Innovation within the herbal tea market is becoming increasingly vital as brands strive to differentiate themselves in a competitive landscape. Japanese consumers are showing a growing interest in unique flavor profiles and functional blends that cater to specific health needs. For instance, herbal teas infused with adaptogens or superfoods are gaining popularity, appealing to health-conscious individuals. The introduction of ready-to-drink herbal tea products is also reshaping the market, providing convenience for on-the-go consumers. This trend suggests that the herbal tea market must continuously adapt to evolving consumer preferences to maintain growth. As a result, companies that invest in research and development to create innovative products are likely to capture a larger share of the market.

Cultural Heritage and Tradition

Japan's rich cultural heritage plays a significant role in shaping consumer preferences within the herbal tea market. Traditional herbal remedies and teas have been part of Japanese culture for centuries, and this historical context continues to influence modern consumption patterns. The herbal tea market benefits from this deep-rooted appreciation for natural ingredients and traditional brewing methods. As consumers seek authenticity and connection to their cultural roots, herbal teas that emphasize traditional practices are likely to resonate well. This cultural integration not only enhances the market's appeal but also encourages the preservation of traditional herbal knowledge, which may further stimulate interest in herbal tea products.

E-commerce Growth and Accessibility

The rise of e-commerce is transforming the way consumers access products, including those in the herbal tea market. With the increasing penetration of the internet and mobile devices in Japan, online shopping has become a preferred method for many consumers. This trend is particularly relevant for niche products like herbal teas, which may not be readily available in all retail outlets. The herbal tea market is likely to benefit from this shift, as e-commerce platforms provide greater accessibility and convenience for consumers. Additionally, online retailers often offer a wider variety of products, allowing consumers to explore different brands and flavors. This increased accessibility may contribute to the overall growth of the herbal tea market.

Sustainability and Eco-Consciousness

The growing emphasis on sustainability and eco-friendly practices is becoming a crucial driver for the herbal tea market. Japanese consumers are increasingly concerned about the environmental impact of their purchases, leading to a preference for brands that prioritize sustainable sourcing and packaging. The herbal tea market is responding to this demand by adopting eco-friendly practices, such as using biodegradable packaging and sourcing ingredients from organic farms. This shift towards sustainability not only aligns with consumer values but also enhances brand loyalty. As a result, companies that effectively communicate their commitment to sustainability are likely to gain a competitive edge in the market.