Innovative Marketing Strategies

The energy drinks market in Japan is witnessing a transformation driven by innovative marketing strategies. Brands are increasingly leveraging digital platforms and social media to engage consumers, creating interactive campaigns that resonate with their target audience. In 2025, it is estimated that digital marketing expenditures in the energy drinks market will account for over 30% of total marketing budgets. This shift towards digital engagement allows brands to connect with consumers in real-time, fostering brand loyalty and awareness. Additionally, experiential marketing events, such as pop-up stores and sponsorships of sports events, are becoming prevalent, further enhancing brand visibility and consumer interaction.

Expansion of Distribution Channels

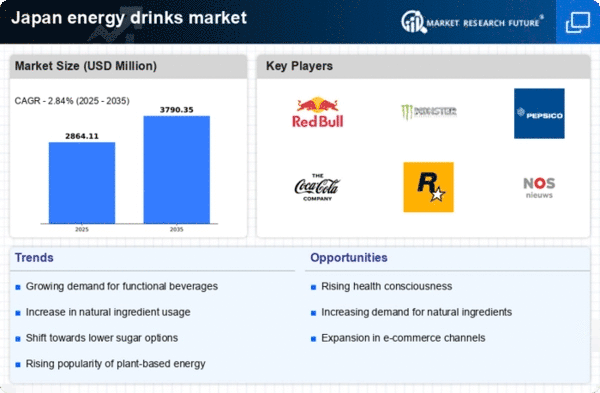

The energy drinks market in Japan is experiencing a significant expansion of distribution channels, which is crucial for reaching a broader consumer base. Traditional retail outlets, convenience stores, and supermarkets remain vital, but there is a marked increase in online sales channels. As of 2025, e-commerce is projected to account for approximately 25% of total energy drink sales in Japan, reflecting changing shopping habits among consumers. The energy drinks market is adapting to this trend by enhancing online presence and optimizing supply chains to ensure product availability. This diversification in distribution not only increases accessibility but also caters to the growing preference for online shopping.

Youth Culture and Lifestyle Trends

The energy drinks market in Japan is significantly influenced by the lifestyle choices of the youth demographic. Young consumers, particularly those aged 18-34, are drawn to energy drinks as a means to boost their performance during academic and social activities. This demographic is characterized by a fast-paced lifestyle, often requiring quick energy solutions. As of 2025, approximately 40% of energy drink consumers in Japan fall within this age group, indicating a strong correlation between youth culture and market growth. The energy drinks market is thus focusing on marketing strategies that resonate with this audience, utilizing social media and influencer partnerships to enhance brand visibility.

Rising Demand for Functional Beverages

The energy drinks market in Japan experiences a notable surge in demand for functional beverages. Consumers increasingly seek products that offer more than just energy; they desire added benefits such as vitamins, minerals, and herbal extracts. This trend aligns with a broader shift towards health and wellness, where individuals are more discerning about their beverage choices. In 2025, the market for functional energy drinks is projected to grow by approximately 15%, reflecting a growing consumer preference for products that enhance physical and mental performance. The energy drinks market is thus adapting to these evolving consumer expectations by innovating formulations that cater to health-conscious individuals.

Focus on Sustainability and Eco-Friendly Practices

The energy drinks market in Japan is increasingly focusing on sustainability and eco-friendly practices, responding to consumer demand for environmentally responsible products. Brands are exploring sustainable sourcing of ingredients and eco-friendly packaging solutions to minimize their environmental impact. In 2025, it is anticipated that around 20% of energy drink consumers will prioritize sustainability in their purchasing decisions. The energy drinks market is thus likely to see a rise in products that emphasize organic ingredients and recyclable packaging. This shift not only aligns with global sustainability trends but also positions brands favorably among environmentally conscious consumers.