Evolving Consumer Preferences

Consumer preferences in Japan are evolving towards more convenient and integrated payment solutions, which significantly impacts the direct carrier-billing market. As consumers increasingly seek frictionless payment experiences, direct carrier billing emerges as a preferred option due to its simplicity and security. Recent surveys indicate that approximately 70% of mobile users in Japan express a preference for carrier billing over traditional payment methods for digital content. This shift in consumer behavior suggests that the direct carrier-billing market is well-positioned to capitalize on the demand for user-friendly payment solutions. Furthermore, the integration of carrier billing with popular mobile applications enhances its attractiveness, as users can make purchases without the need for credit cards or external payment platforms. This trend is likely to drive further adoption and growth within the direct carrier-billing market.

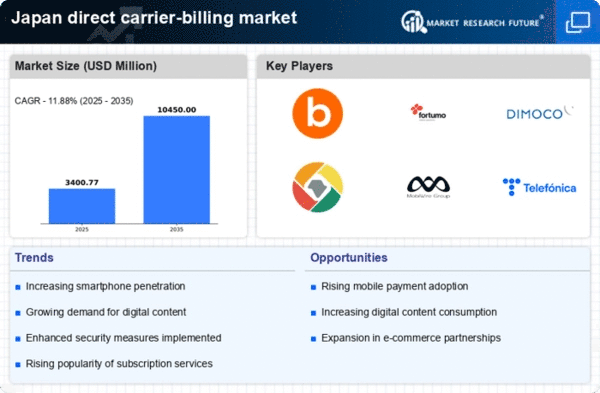

Rising Smartphone Penetration

The increasing penetration of smartphones in Japan is a pivotal driver for the direct carrier-billing market. As of 2025, smartphone ownership in Japan is estimated to exceed 90%, facilitating seamless access to mobile applications and digital content. This trend indicates a growing consumer base that prefers mobile transactions, thereby enhancing the appeal of direct carrier billing as a convenient payment method. The direct carrier-billing market benefits from this shift, as users are more inclined to make in-app purchases and subscriptions directly through their mobile carriers. This not only simplifies the payment process but also reduces friction, leading to higher conversion rates for digital content providers. Consequently, the direct carrier-billing market is likely to experience substantial growth, driven by the increasing reliance on smartphones for everyday transactions.

Expansion of Digital Content Services

The expansion of digital content services in Japan is a significant driver for the direct carrier-billing market. With the proliferation of streaming platforms, gaming applications, and e-commerce services, the demand for convenient payment methods has surged. As of 2025, the digital content market in Japan is projected to reach over $20 billion, with a substantial portion of transactions being facilitated through direct carrier billing. This growth indicates a robust opportunity for the direct carrier-billing market to capture a share of the increasing digital economy. The ability to charge purchases directly to mobile accounts simplifies the payment process for consumers, encouraging higher spending on digital content. As more service providers adopt direct carrier billing, the market is likely to witness accelerated growth, driven by the expanding array of digital offerings available to consumers.

Technological Advancements in Payment Systems

Technological advancements in payment systems are reshaping the landscape of the direct carrier-billing market. Innovations such as enhanced security protocols, biometric authentication, and improved user interfaces are making carrier billing more appealing to consumers. In Japan, the integration of advanced technologies into mobile payment systems is expected to increase consumer trust and adoption rates. As of 2025, it is estimated that the implementation of these technologies could boost the direct carrier-billing market by up to 30%. This technological evolution not only enhances the user experience but also addresses concerns related to security and fraud, which are critical in the digital payment space. Consequently, the direct carrier-billing market is likely to benefit from these advancements, as they facilitate a more secure and efficient payment process for users.

Regulatory Framework Supporting Digital Payments

The regulatory framework in Japan is increasingly supportive of digital payment solutions, which serves as a crucial driver for the direct carrier-billing market. Recent initiatives by the Japanese government aim to promote cashless transactions and enhance the overall digital payment ecosystem. This regulatory support is likely to foster innovation within the direct carrier-billing market, encouraging telecom operators and service providers to collaborate and develop new solutions. As regulations evolve to accommodate emerging payment technologies, the direct carrier-billing market is expected to benefit from increased legitimacy and consumer confidence. Furthermore, the alignment of regulatory policies with industry standards may facilitate smoother operations and reduce barriers to entry for new players, potentially leading to a more competitive market landscape.