Cost Efficiency and Waste Reduction

Cost efficiency is a critical driver for the dental 3d-printing market in Japan. Traditional dental manufacturing processes often involve significant material waste and high labor costs. In contrast, 3D printing technology minimizes waste by using only the necessary amount of material, which can lead to cost savings of up to 30%. Additionally, the ability to produce dental products on-demand reduces inventory costs for dental practices. As dental professionals become more aware of these financial benefits, the adoption of 3D printing is expected to increase, thereby enhancing the overall market landscape.

Rising Demand for Aesthetic Dentistry

The growing consumer preference for aesthetic dentistry is significantly influencing the dental 3d-printing market in Japan. Patients are increasingly seeking customized solutions for dental implants, crowns, and aligners that enhance their appearance. This trend is reflected in the market data, which indicates that the aesthetic segment accounts for nearly 40% of the total dental procedures. As a result, dental practitioners are turning to 3D printing to meet this demand, allowing for the production of tailored dental solutions that align with individual patient needs. This shift towards aesthetic-focused treatments is likely to propel the market further.

Technological Advancements in 3D Printing

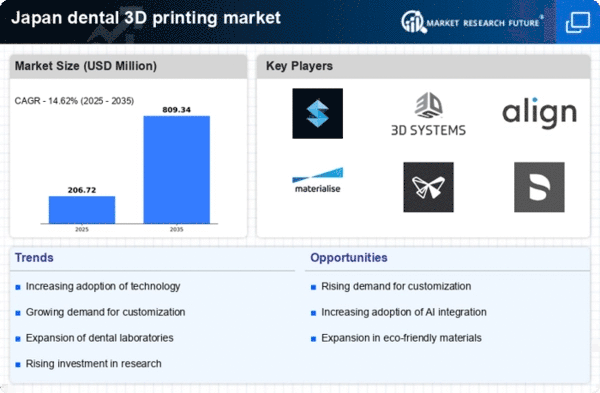

The dental 3d-printing market in Japan is experiencing a surge due to rapid technological advancements. Innovations in 3D printing technologies, such as improved resolution and speed, are enhancing the quality of dental products. For instance, the introduction of high-precision printers allows for the creation of intricate dental models and prosthetics. This has led to a notable increase in the adoption of 3D printing in dental practices, with a reported growth rate of approximately 25% annually. As dental professionals seek to provide better patient outcomes, the integration of advanced 3D printing technologies is becoming essential, thereby driving the market forward.

Increased Investment in Dental Technologies

Investment in dental technologies is a significant driver for the dental 3d-printing market in Japan. Both private and public sectors are channeling funds into research and development of advanced dental solutions. Recent reports indicate that investments in dental technology have increased by over 15% in the past year. This influx of capital is facilitating the development of new materials and techniques for 3D printing, which enhances the capabilities of dental practices. As more resources are allocated to this sector, the market is poised for substantial growth, reflecting the increasing importance of technological innovation in dentistry.

Regulatory Support and Standards Development

The dental 3d-printing market in Japan is benefiting from supportive regulatory frameworks and the establishment of industry standards. The Japanese government is actively promoting the use of advanced manufacturing technologies, including 3D printing, in healthcare. This support is evident in initiatives aimed at streamlining the approval processes for new dental products. Furthermore, the development of standards for 3D-printed dental devices ensures safety and efficacy, which is crucial for gaining consumer trust. As regulatory bodies continue to foster an environment conducive to innovation, the market is likely to see accelerated growth.