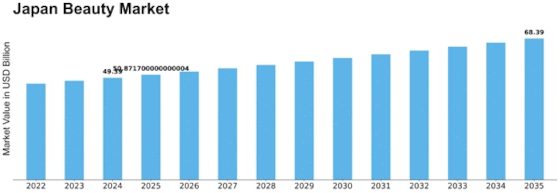

Japan Beauty Size

Japan Beauty Market Growth Projections and Opportunities

The global toothpaste market has experienced sustained demand in recent years, and the trajectory continues to be promising, with a projected value reaching USD 21,642.0 million at a Compound Annual Growth Rate (CAGR) of 4.80% by 2025. This robust growth is propelled by significant innovations in product offerings, coupled with intensive research and development initiatives and collaborative efforts among industry players.

Regional Insights: Asia-Pacific Dominance and North American Growth

In 2017, the Asia-Pacific region asserted its dominance, commanding the largest market share of 31.90%, valued at USD 4,994.6 million. This region is anticipated to maintain its leadership position, with a projected CAGR of 5.25% during the forecast period. North America, the second-largest market in 2017 at USD 4,369.3 million, is expected to register a commendable CAGR of 4.91%. These regional dynamics underscore the global nature of the toothpaste market, with Asia-Pacific representing a pivotal hub for growth.

Moreover, in terms of market volume, the Asia-Pacific region claimed a 33.87% market share in 2017, totaling 2,072.7 million units. The forecast predicts a CAGR of 3.90%, reinforcing the sustained demand for toothpaste in this region. North America, with 1,465.8 million units in 2017, is projected to witness a CAGR of 3.75%. These figures underline the robust consumer demand for toothpaste across both mature and emerging markets.

Segmentation Insights: Whitening Dominance and Sensitivity Growth

The toothpaste market is segmented based on consumer needs, with whitening and sensitivity being prominent categories. The whitening segment led the market in 2017 with a substantial market share of 24.33%, valued at USD 3,665.0 million. This segment is poised to maintain its dominance, with a projected CAGR of 3.29%. The sensitivity segment, the second-largest in 2017 at USD 3,639.9 million, is expected to register a notable CAGR of 5.31%, reflecting a growing consumer preference for specialized oral care products.

In terms of market volume, the whitening segment secured the largest share of 25.55% in 2017, comprising 1,514.9 million units. Despite a slightly lower CAGR of 2.12%, this segment remains a significant driver of market volume. The sensitivity segment, with 1,363.0 million units in 2017, is expected to register a CAGR of 4.18%, indicating a noteworthy growth trajectory.

Retail Channels: Store-Based Dominance and Non-Store-Based Surge

The distribution channels for toothpaste are divided into store-based and non-store-based segments. In 2017, the store-based segment accounted for a substantial market share of 66.71%, amounting to USD 10,047.9 million. This segment is predicted to sustain its dominance with a CAGR of 4.00%. The non-store-based segment, valued at USD 5,013.5 million, is expected to exhibit a higher CAGR of 6.27%, reflecting changing consumer preferences and the increasing popularity of online retail channels.

In terms of market volume, the store-based segment claimed a larger market share of 65.27% in 2017, representing 3,870.6 million units. The forecast anticipates a CAGR of 2.93% for this segment. Conversely, the non-store-based segment, with 2,059.1 million units in 2017, is projected to exhibit a higher CAGR of 4.74%, signaling a growing shift towards digital platforms for toothpaste purchases.

The global toothpaste market is characterized by dynamic regional landscapes, evolving consumer preferences, and a robust segmentation that caters to diverse oral care needs. The projected growth and emerging trends reflect the resilience of this market, with Asia-Pacific leading the charge, innovative product offerings driving demand, and a shifting retail landscape responding to changing consumer behaviors.

Leave a Comment