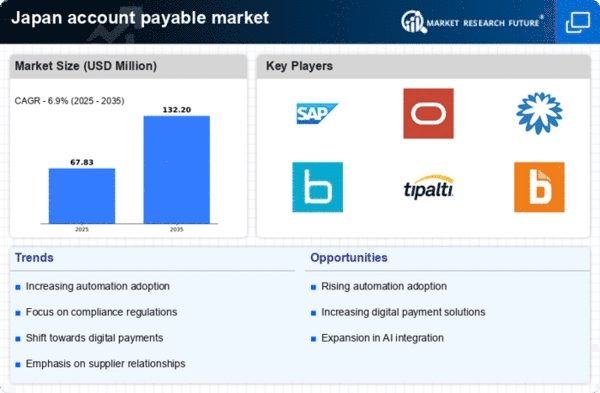

Shift Towards Digital Payment Solutions

The The account payable market in Japan is witnessing a significant shift towards digital payment solutions. With the rise of e-commerce and online transactions, businesses are increasingly adopting electronic invoicing and payment methods. This transition is driven by the need for faster, more secure payment options that enhance cash flow management. Recent statistics indicate that electronic payments account for over 50% of total transactions in the corporate sector. As organizations seek to improve operational efficiency and reduce reliance on paper-based processes, the demand for digital payment solutions is expected to surge. This trend not only streamlines the payment process but also aligns with the broader movement towards digital transformation in the account payable market.

Regulatory Changes and Compliance Requirements

The The account payable market in Japan is significantly influenced by evolving regulatory changes and compliance requirements. The Japanese government has implemented stricter regulations regarding financial reporting and tax compliance, compelling organizations to adopt more robust accounting practices. Companies are now required to maintain accurate records and ensure timely payments to avoid penalties. This regulatory landscape is driving the demand for sophisticated account payable solutions that can automate compliance processes and provide audit trails. As a result, businesses are increasingly investing in software that not only streamlines payment processes but also ensures adherence to legal standards. The emphasis on compliance is expected to propel growth in the account payable market, as organizations seek to mitigate risks associated with non-compliance.

Rising Demand for Real-Time Financial Insights

The The account payable market in Japan is increasingly driven by the rising demand for real-time financial insights. Businesses are seeking greater visibility into their financial operations to make informed decisions and optimize cash flow. The ability to access real-time data on outstanding invoices and payment statuses is becoming essential for effective financial management. Companies are investing in advanced analytics tools that provide insights into spending patterns and cash flow forecasts. This trend is indicative of a broader shift towards data-driven decision-making in the account payable market. As organizations strive for greater financial agility, the demand for solutions that offer real-time insights is likely to grow, further shaping the landscape of the account payable market.

Technological Advancements in Payment Processing

The The account payable market in Japan is experiencing a notable transformation due to rapid technological advancements in payment processing. Innovations such as artificial intelligence and machine learning are streamlining invoice processing and approval workflows. This shift is expected to enhance efficiency, reduce errors, and lower operational costs. According to recent data, organizations that adopt automated solutions can reduce processing costs by up to 30%. Furthermore, the integration of cloud-based platforms allows for real-time access to financial data, facilitating better decision-making. As businesses increasingly recognize the benefits of these technologies, the demand for advanced payment solutions in the account payable market is likely to grow, driving further investment in automation and digital tools.

Increased Focus on Supplier Relationship Management

In the account payable market, there is a growing emphasis on supplier relationship management in Japan. Companies are recognizing the importance of maintaining strong relationships with suppliers to ensure timely deliveries and favorable payment terms. This focus is leading organizations to invest in technologies that facilitate better communication and collaboration with suppliers. By leveraging data analytics, businesses can gain insights into supplier performance and payment patterns, enabling them to negotiate better terms. This strategic approach to supplier management is likely to enhance operational efficiency and reduce costs in the account payable market. As organizations prioritize supplier relationships, the demand for integrated solutions that support these initiatives is expected to rise.