Rising Demand for Cost-Effective Solutions

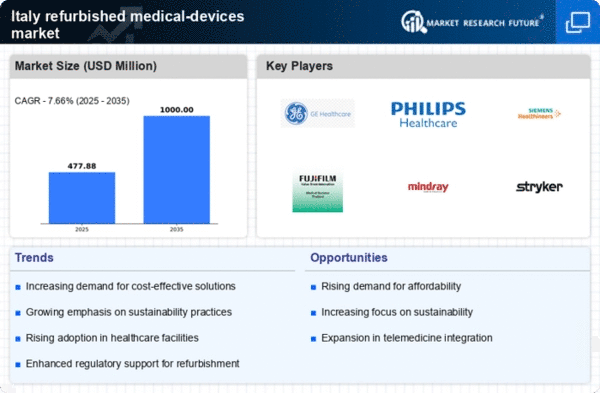

The refurbished medical-devices market in Italy is experiencing a notable increase in demand for cost-effective healthcare solutions. Hospitals and clinics are increasingly seeking ways to manage budgets while maintaining high-quality patient care. The rising costs of new medical equipment, which can exceed €100,000 for advanced imaging systems, have prompted healthcare providers to consider refurbished alternatives. This trend is particularly evident in smaller healthcare facilities that may lack the financial resources to invest in new technologies. As a result, the refurbished medical-devices market is projected to grow at a CAGR of approximately 8% over the next five years, indicating a strong shift towards more affordable options in the healthcare sector.

Increased Focus on Healthcare Accessibility

The refurbished medical-devices market in Italy is being driven by an increased focus on healthcare accessibility. As the Italian government emphasizes the importance of equitable healthcare access, refurbished medical devices are seen as a viable solution to bridge the gap in underserved areas. By providing high-quality refurbished equipment at lower costs, healthcare facilities can enhance their service offerings without straining budgets. This is particularly relevant in rural regions where new medical devices may be prohibitively expensive. The market is expected to see a rise in demand for refurbished devices, as they play a crucial role in improving healthcare delivery across diverse populations.

Technological Advancements in Refurbishment Processes

Technological advancements in refurbishment processes are significantly impacting the refurbished medical-devices market in Italy. Enhanced techniques and equipment for refurbishing medical devices have improved the quality and reliability of these products. For instance, the integration of advanced diagnostic tools and software during the refurbishment process ensures that devices meet stringent safety and performance standards. This has led to increased confidence among healthcare providers in purchasing refurbished equipment. Moreover, the market is witnessing a rise in the adoption of refurbished imaging devices, which are often refurbished to a condition comparable to new devices, thus expanding their appeal in the healthcare sector.

Supportive Regulatory Framework for Refurbished Devices

A supportive regulatory framework for refurbished devices is emerging in Italy, positively impacting the refurbished medical-devices market. Regulatory bodies are increasingly recognizing the importance of refurbished equipment in the healthcare landscape, leading to the establishment of guidelines that ensure safety and efficacy. This regulatory support fosters confidence among healthcare providers, encouraging them to consider refurbished options. As a result, the market is likely to see an uptick in the adoption of refurbished devices, as compliance with regulatory standards assures quality and safety. This trend is expected to further solidify the position of refurbished medical devices as a reliable choice in the healthcare sector.

Growing Environmental Awareness Among Healthcare Providers

Growing environmental awareness among healthcare providers is influencing the refurbished medical-devices market in Italy. As sustainability becomes a priority, many healthcare institutions are actively seeking ways to reduce their environmental footprint. Refurbished medical devices offer a sustainable alternative to new equipment, as they extend the lifecycle of existing devices and reduce waste. This trend aligns with Italy's commitment to environmental sustainability, as healthcare providers aim to minimize their impact on the environment. The refurbished medical-devices market is likely to benefit from this shift, as more institutions recognize the ecological advantages of choosing refurbished over new equipment.