Growing Regulatory Pressures

In Italy, regulatory compliance is becoming a significant driver for the managed detection-response market. The implementation of stringent data protection regulations, such as the General Data Protection Regulation (GDPR), has compelled organizations to enhance their cybersecurity posture. Non-compliance can result in hefty fines, reaching up to €20 million or 4% of annual global turnover, whichever is higher. This financial risk encourages businesses to adopt managed detection-response services to ensure compliance and safeguard customer data. Furthermore, regulatory bodies are increasingly emphasizing the importance of incident response capabilities, which aligns with the offerings of managed detection-response providers. Consequently, the market is likely to see sustained growth as organizations prioritize compliance and invest in solutions that address regulatory requirements.

Rising Cyber Threat Landscape

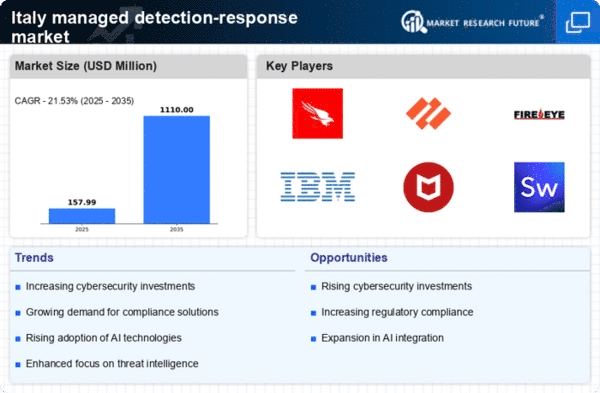

The managed detection-response market in Italy is experiencing growth. This growth is due to an increasingly complex cyber threat landscape. Cyberattacks have become more sophisticated, with a notable rise in ransomware incidents and data breaches. In 2025, it is estimated that cybercrime costs Italian businesses over €10 billion annually, prompting organizations to seek advanced security solutions. This trend indicates a heightened awareness of the need for robust cybersecurity measures, driving demand for managed detection-response services. Companies are recognizing that traditional security measures are insufficient, leading to a shift towards proactive threat detection and response strategies. As a result, the managed detection-response market is likely to expand as businesses invest in comprehensive security frameworks to mitigate risks and protect sensitive data.

Increased Awareness of Cybersecurity Risks

The managed detection-response market in Italy is benefiting from a growing awareness of cybersecurity risks. This awareness is present among both businesses and consumers. As high-profile cyber incidents make headlines, organizations are becoming more cognizant of the potential repercussions of inadequate security measures. Surveys indicate that approximately 70% of Italian companies consider cybersecurity a top priority, leading to increased investments in managed detection-response services. This heightened awareness is fostering a culture of security within organizations, where proactive measures are prioritized over reactive responses. As businesses recognize the value of continuous monitoring and rapid incident response, the managed detection-response market is poised for growth, with more companies seeking to partner with specialized providers to enhance their security capabilities.

Technological Advancements in Security Solutions

Technological advancements are playing a pivotal role in shaping the managed detection-response market in Italy. Innovations in artificial intelligence (AI) and machine learning (ML) are enabling more effective threat detection and response capabilities. These technologies allow for the analysis of vast amounts of data in real-time, identifying anomalies and potential threats with greater accuracy. As organizations increasingly adopt these advanced technologies, the demand for managed detection-response services is likely to rise. In 2025, it is projected that the market for AI-driven cybersecurity solutions will reach €1 billion in Italy, highlighting the potential for growth in this sector. Consequently, managed detection-response providers that leverage cutting-edge technologies are well-positioned to capture a larger share of the market.

Shift Towards Remote Work and Digital Transformation

The shift towards remote work and digital transformation is significantly influencing the managed detection-response market in Italy. As businesses adapt to new operational models, the attack surface has expanded, creating new vulnerabilities. This transition has led to an increased reliance on cloud services and remote access solutions, which require robust security measures. In 2025, it is estimated that 40% of the Italian workforce will continue to work remotely, underscoring the need for effective cybersecurity strategies. Organizations are recognizing that traditional security measures may not suffice in this new landscape, prompting them to seek managed detection-response services that can provide comprehensive protection. This trend indicates a growing market opportunity for providers that can offer tailored solutions to address the unique challenges posed by remote work and digital transformation.