Increased Healthcare Expenditure

Italy's rising healthcare expenditure is a significant driver for the knee replacement market. The government has been allocating more funds towards orthopedic surgeries, reflecting a commitment to improving healthcare services. In recent years, healthcare spending has increased by approximately 5% annually, with a notable portion directed towards surgical interventions. This financial support enables hospitals to upgrade their facilities and invest in advanced technologies, thereby enhancing the quality of care provided to patients. As a result, the knee replacement market is likely to benefit from improved access to surgical procedures, leading to higher patient volumes and better overall outcomes.

Growing Awareness of Joint Health

There is a growing awareness of joint health among the Italian population, which is positively impacting the knee replacement market. Educational campaigns and health initiatives are encouraging individuals to seek medical advice for joint-related issues earlier. This proactive approach leads to timely interventions, including knee replacements, before conditions worsen. As more people become informed about the benefits of surgical options, the demand for knee replacement procedures is expected to rise. The knee replacement market may experience growth as healthcare providers adapt to this shift in patient behavior, potentially leading to an increase in preventive care measures and early surgical interventions.

Rising Incidence of Osteoarthritis

The increasing prevalence of osteoarthritis in Italy is a primary driver for the knee replacement market. As the population ages, the incidence of this degenerative joint disease rises, leading to a greater demand for surgical interventions. Recent statistics indicate that approximately 10% of the Italian population suffers from osteoarthritis, with a significant portion requiring knee replacements. This trend is expected to continue, as the aging demographic is projected to grow, thereby increasing the number of patients seeking knee replacement procedures. The knee replacement market is likely to see a surge in demand as healthcare providers respond to this growing need, potentially leading to advancements in surgical techniques and implant technologies.

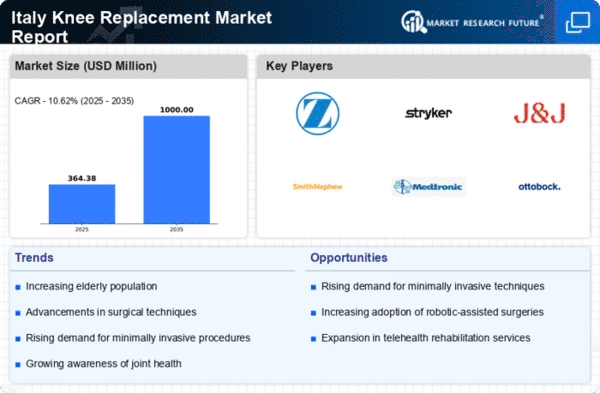

Advancements in Surgical Techniques

Innovations in surgical techniques are transforming the knee replacement market in Italy. Minimally invasive procedures, such as arthroscopy, are gaining traction, allowing for quicker recovery times and reduced hospital stays. These advancements not only enhance patient outcomes but also attract more individuals to consider knee replacement surgery. The introduction of robotic-assisted surgeries is also noteworthy, as it improves precision and reduces complications. As these technologies become more widely adopted, the knee replacement market is expected to expand, with an increasing number of healthcare facilities investing in state-of-the-art surgical equipment. This trend may lead to a more competitive market landscape, driving down costs and improving accessibility for patients.

Rising Demand for Customized Implants

The trend towards personalized medicine is influencing the knee replacement market in Italy, particularly in the demand for customized implants. Patients are increasingly seeking tailored solutions that cater to their specific anatomical needs and lifestyle preferences. This shift is prompting manufacturers to invest in research and development to create innovative implant designs that enhance functionality and longevity. The knee replacement market is likely to see a rise in the availability of bespoke implants, which could improve patient satisfaction and outcomes. As customization becomes more prevalent, it may also drive competition among manufacturers, leading to advancements in materials and technologies used in knee replacement surgeries.