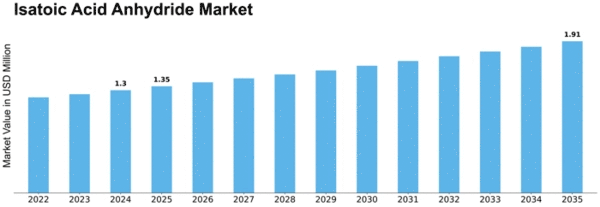

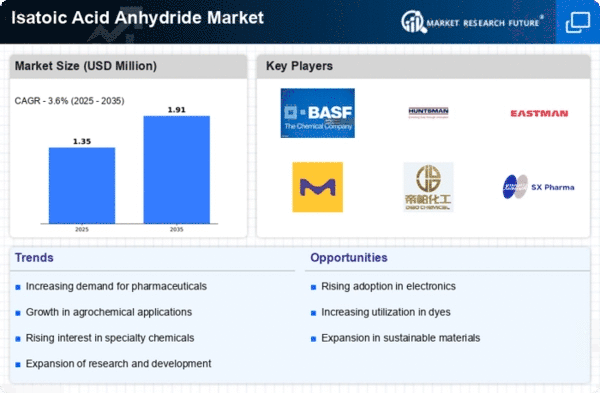

Isatoic Acid Anhydride Size

Isatoic Acid Anhydride Market Growth Projections and Opportunities

The Isatoic Acid Anhydride market is influenced by a variety of factors that collectively shape its growth and dynamics. One primary driver is the demand from the pharmaceutical and dye industries where isatoic acid anhydride serves as a crucial intermediate in the synthesis of various compounds. Its versatile reactivity makes it valuable in pharmaceutical applications, particularly in the production of medicines and agrochemicals. Additionally, the dye industry utilizes isatoic acid anhydride as a key component in the synthesis of vat dyes. As these industries continue to expand globally, the demand for isatoic acid anhydride rises, contributing significantly to the growth of the market.

Technological advancements play a pivotal role in the evolution of the Isatoic Acid Anhydride market. Ongoing research and development efforts focus on optimizing production processes, improving purity levels, and developing more efficient and environmentally friendly synthesis methods. The continuous pursuit of innovations ensures that isatoic acid anhydride manufacturers can meet the stringent quality requirements of end-users while also aligning with industry trends towards sustainability and greener chemical processes.

Market dynamics are significantly influenced by trends in end-use industries, with pharmaceuticals and dyes being major drivers. The demand for isatoic acid anhydride in pharmaceutical applications, such as the production of medicines and agrochemicals, is closely linked to trends in drug discovery and development. Similarly, the dye industry's requirements for vat dyes impact the market dynamics. Understanding and adapting to the specific needs and trends in these end-use industries are crucial for isatoic acid anhydride manufacturers to stay competitive and meet the changing demands of consumers.

Global regulatory frameworks and safety considerations contribute to shaping the Isatoic Acid Anhydride market. Governments and regulatory bodies impose strict regulations to ensure the safe handling, transportation, and use of chemicals like isatoic acid anhydride. Compliance with these regulations is essential for industry players to maintain market access and meet the standards set for environmental protection and workplace safety. Additionally, adherence to international quality standards enhances the market credibility of isatoic acid anhydride manufacturers.

Raw material availability and pricing dynamics play a crucial role in the Isatoic Acid Anhydride market. The primary raw materials for isatoic acid anhydride, such as anthranilic acid, can experience fluctuations in supply and cost. Effective supply chain management and strategic sourcing become crucial for manufacturers to ensure stable production and pricing of isatoic acid anhydride. Maintaining a reliable and cost-effective supply of raw materials is essential for industry players to mitigate potential disruptions.

Market competition is another pivotal factor influencing the Isatoic Acid Anhydride sector. The presence of numerous players in the market drives continuous innovation in terms of production efficiency, product quality, and cost competitiveness. Companies vie for market share by offering high-purity isatoic acid anhydride, developing customized solutions, and enhancing their manufacturing capabilities. Strategic collaborations, partnerships, and mergers and acquisitions are common strategies employed by companies to strengthen their market position and stay competitive in a dynamic industry.

Consumer preferences and market trends also contribute to shaping the Isatoic Acid Anhydride market. The demand for isatoic acid anhydride is driven by the requirements of downstream industries, particularly pharmaceuticals and dyes. Consumer preferences for high-quality, pure, and reliable isatoic acid anhydride influence purchasing decisions, emphasizing the importance of maintaining product quality and consistency in this market.

Leave a Comment