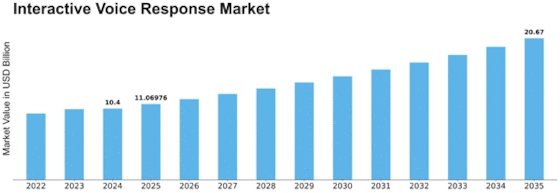

Interactive Voice Response Size

Interactive Voice Response Market Growth Projections and Opportunities

The Interactive Voice Response (IVR) market, a pivotal component of modern communication systems, is witnessing intense competition among various players vying for market share. Market share positioning strategies play a crucial role in determining the success and sustainability of companies within this dynamic landscape. One prevalent approach is differentiation, where companies strive to set themselves apart by offering unique features or specialized services. This may involve the integration of advanced natural language processing capabilities, personalized customer interactions, or compatibility with emerging technologies such as artificial intelligence.

Another strategic avenue is cost leadership, focusing on providing IVR solutions at a competitive price point without compromising on quality. Companies adopting this strategy aim to capture a larger market share by appealing to cost-conscious customers while maintaining a high standard of performance and reliability. This approach requires efficient operational processes, economies of scale, and strategic partnerships to drive down production and maintenance costs.

Market segmentation is also a key strategy employed by companies in the IVR market. By targeting specific industry verticals or customer segments, companies can tailor their solutions to meet the unique needs and preferences of those groups. For example, IVR systems designed for healthcare may prioritize features like patient data security and compliance with industry regulations, while those targeting e-commerce may emphasize order tracking and customer support functionalities.

Collaboration and partnerships constitute another avenue for market share positioning. In an era of interconnected technologies, forging alliances with other technology providers or communication platforms can enhance the overall value proposition of IVR solutions. Integration with popular customer relationship management (CRM) systems, messaging platforms, and other communication tools can broaden the reach of IVR solutions and make them more appealing to businesses seeking seamless and integrated communication solutions.

Innovation is a cornerstone strategy for companies aiming to secure a prominent position in the IVR market. Staying ahead of technological advancements and customer expectations is critical. Companies investing in research and development to introduce cutting-edge features, such as voice biometrics, real-time analytics, and omnichannel capabilities, can attract businesses looking for state-of-the-art IVR solutions. Continuous improvement and adaptation to emerging trends are essential for maintaining a competitive edge.

Customer experience (CX) has become a focal point for market share positioning in the IVR industry. Companies recognize that delivering a positive and user-friendly experience is paramount. Implementing intuitive interfaces, reducing wait times, and personalizing interactions contribute to enhanced customer satisfaction. Positive customer experiences not only foster loyalty but also serve as a powerful marketing tool, as satisfied customers are more likely to recommend the product to others.

Leave a Comment