Top Industry Leaders in the Intelligent Transportation System Market

Competitive Landscape of Intelligent Transportation System Market:

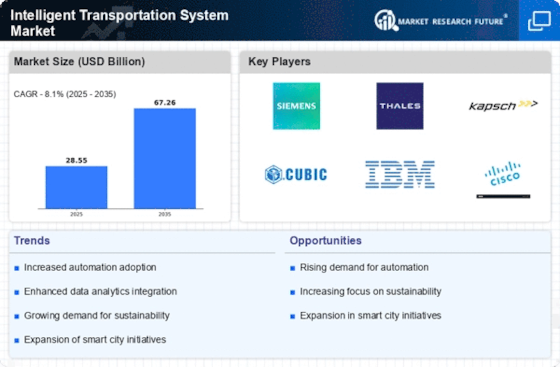

The intelligent transportation system (ITS) market is experiencing steady growth, driven by increasing urbanization, traffic congestion concerns, and growing awareness of environmental sustainability. As a result, the landscape is becoming increasingly competitive, with established players solidifying their positions and new entrants seeking to carve out a niche. This report provides an overview of the competitive landscape, including key players, their strategies, and factors influencing market share.

Key Players:

- Roper Technologies Inc. (US)

- Hitachi Ltd (Japan)

- Siemens AG (Germany)

- Thales Group (France)

- Xerox Corporation (US)

- BRISA (Portugal)

- Kapsch Trafficcom (Austria)

- Q Free (Norway)

- Efkon AG (Austria)

- Lanner Electronics Inc. (Taiwan)

- Denso Corporation (Japan)

- TomTom International BV (Netherlands)

- Savari Inc. (US)

- Nuance Communication Inc. (US)

- Garmin Ltd (US)

Strategies Adopted by Key Players:

- Market expansion: Key players are expanding their reach through acquisitions, mergers, and joint ventures. For example, Bosch acquired ERS Electronic in 2019 to strengthen its offering in traffic management solutions.

- Technological innovation: Companies are investing heavily in research and development to create advanced ITS solutions, including those that leverage artificial intelligence, cloud computing, and big data analytics. For example, Siemens launched its MindSphere IoT platform to connect various transportation infrastructure elements and facilitate data-driven decision-making.

- Partnerships and collaborations: Strategic partnerships are becoming increasingly common as companies seek to combine their expertise and resources to develop comprehensive ITS solutions. For example, IBM partnered with Cisco Systems to offer a connected car platform.

- Customization and regional focus: To cater to diverse market needs, companies are customizing their solutions to specific regional requirements. For example, Kapsch TrafficCom offers solutions tailored for the European market, while TOMTOM focuses on North America.

Factors for Market Share Analysis:

- Product portfolio and technological leadership: Companies with a diverse and innovative product portfolio are better positioned to gain market share.

- Geographical reach and regional focus: Companies with a strong presence in key markets and a tailored approach to regional needs are likely to enjoy a competitive advantage.

- Financial strength and investment capacity: Companies with strong financial resources can invest in research and development, marketing, and acquisitions, allowing them to maintain a competitive edge.

- Customer base and brand reputation: Companies with a large and loyal customer base and a strong brand reputation are able to command premium pricing and attract new customers.

- Partnerships and collaborations: Strategic partnerships can offer access to new markets, technologies, and resources, thereby contributing to increased market share.

New and Emerging Companies:

The ITS market is attracting a growing number of new entrants, including startups and technology companies. These companies often focus on specific niche areas, such as connected car technology, autonomous vehicles, and smart parking solutions. Some notable examples include Savari Inc. (V2X communication), Nauto (driver behavior monitoring), and Parkopedia (parking management solutions).

Current Company Investment Trends:

Companies across the ITS market are investing heavily in research and development, particularly in areas such as artificial intelligence, big data analytics, and cloud computing. This is driven by the increasing demand for data-driven solutions that can improve traffic management, reduce congestion, and enhance safety. Additionally, companies are investing in expanding their product portfolios and entering new markets to capitalize on the growth potential of the ITS market.

Latest Company Updates:

iTMS, a new solution from 3SC Solutions, was introduced at the Express Logistics and Supply Chain Conclave in 2023. In 2023, 3SC Solutions made an announcement at the Express Logistics and Supply Chain Conclave on the debut of iTMS. Using cutting-edge analytics, this high-performance platform facilitates end-to-end transportation planning, settlement, and execution, enabling both cost-effectiveness and superior logistics.

Volvo Trucks Introduces New Safety Systems in 2023. Using a front radar and camera, the system is intended to identify if a bike or pedestrian is in the danger zone in front of the truck and alert the driver. One element that has been designed to help drivers' tasks while also improving the safety of bicycles and pedestrians is the new Front Short Range.

With the launch of BC Transit's new electronic pricing system, Umo, in 2023, transit payment options have significantly improved. Umo made its debut when it was integrated into the whole transport network of the Victoria Regional transport System.