Market Share

Introduction: Navigating the Competitive Landscape of Integrated Circuit Chips

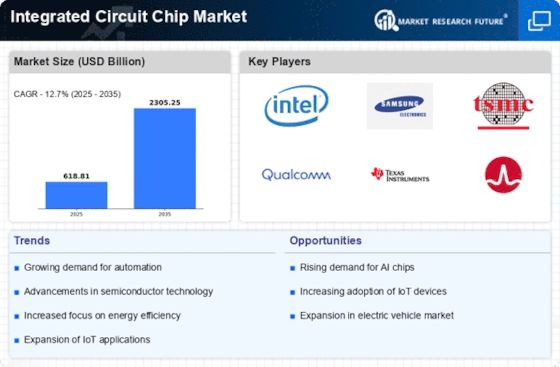

The integrated circuits market is undergoing a great competition, due to the rapid development of technology, the regulatory changes, and the increase in the requirements for performance and the environment. The leading players, such as the original equipment manufacturers, the IT system integrators and the system operators, are using advanced technology, such as artificial intelligence, automation and the integration of the Internet of Things, to take advantage of this trend. Artificial intelligence start-ups have also become a new force in the market, and they have launched a variety of new solutions to enhance the performance and efficiency of the integrated circuits. In the future, the differentiation will come from the ability to build green and biometrics, which can meet the requirements of the environment. Especially in 2024 and 2025, the Asia-Pacific and North American regions have the greatest potential for growth, because the strategic deployment of integrated circuits is in line with the local demand for high-speed servers and smart devices. This is a dynamic trend that must be taken advantage of by the leaders.

Competitive Positioning

Full-Suite Integrators

These vendors provide comprehensive solutions across various segments of the integrated circuit market, leveraging extensive portfolios to meet diverse customer needs.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Intel Corporation | Leading in high-performance computing | Microprocessors and SoCs | Global |

| Texas Instruments Inc | Strong analog and embedded processing expertise | Analog and embedded solutions | Global |

| NXP Semiconductors N.V. | Expertise in automotive and IoT solutions | Automotive and secure connectivity | Global |

Specialized Technology Vendors

These vendors focus on niche markets or specific technologies, offering specialized products that cater to unique applications.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| Analog Devices Inc | High-performance analog and mixed-signal solutions | Signal processing and data conversion | Global |

| Infineon Technologies AG | Strong in power management and automotive ICs | Power semiconductors and security solutions | Global |

| STMicroelectronics N.V. | Diverse product range across multiple sectors | Microcontrollers and sensors | Global |

| MediaTek Inc | Leading in mobile and wireless technologies | SoCs for mobile and smart devices | Asia, Global |

Infrastructure & Equipment Providers

These vendors supply essential components and equipment that support the manufacturing and functionality of integrated circuits.

| Vendor | Competitive Edge | Solution Focus | Regional Focus |

|---|---|---|---|

| On Semiconductor Corporation | Focus on energy-efficient solutions | Power management and sensors | Global |

| Renesas Electronics Corporation | Strong in microcontrollers and automotive solutions | Microcontrollers and automotive ICs | Global |

| Microchip Technology Inc | Comprehensive embedded control solutions | Microcontrollers and analog products | Global |

Emerging Players & Regional Champions

- SiFive (USA) – Specialises in RISC-V based custom silicon solutions. Recently signed several contracts with automobile companies for next-generation chip designs. Taking on the established suppliers like Intel and ARM with more flexible and cheaper alternatives.

- The United States Syntiant is a company that specializes in low-power AI chips for edge devices. It has a long-term partnership with many well-known home appliance brands and has a deep integration into smart home products. Its products complement the capabilities of traditional chip manufacturers.

- Sierra Wireless (Canada): Offers IoT-focused integrated circuits and modules, recently implemented solutions for smart city projects, positioning itself as a regional champion in the IoT space and challenging larger players like Qualcomm.

- Silex Microsystems (Sweden): MEMS-based solutions for various applications. Having recently expanded its production capabilities to meet the growing demand in the automotive and medical industries, it complements the established players with its own niche MEMS technology.

Regional Trends: In 2023, North America and Europe will adopt the IC technology, mainly driven by the demand for IoT and AI applications. There are many companies that have specialized in automobiles, medical care and smart devices. The products are more diversified and are expected to challenge the traditional IC industry. The design of chips is more focused on energy conservation and low-power consumption, which will also affect the specialization of IC technology in different regions.

Collaborations & M&A Movements

- NVIDIA and ARM Holdings entered into a partnership to develop advanced AI chips, aiming to enhance their competitive positioning in the AI and machine learning sectors amidst increasing demand for high-performance computing.

- Intel acquired Tower Semiconductor for $5.4 billion to expand its manufacturing capabilities and diversify its product offerings in the integrated circuit market, strengthening its position against competitors like TSMC and Samsung.

- Qualcomm and Google Cloud formed a collaboration to optimize cloud-based AI applications on Qualcomm's Snapdragon platforms, enhancing their market share in the growing edge computing segment.

Competitive Summary Table

| Capability | Leading Players | Remarks |

|---|---|---|

| Biometric Self-Boarding | Qualcomm, NXP Semiconductors | Biometric sensors have been incorporated into the Qualcomm chipsets, increasing the security and convenience of self-boarding systems. NXP chipsets are widely used at airports for fast, accurate data processing. |

| AI-Powered Ops Mgmt | Intel, NVIDIA | Intel’s latest chips use artificial intelligence to optimize resource allocation in real time. Nvidia’s data-center GPUs have demonstrated their unique ability to exploit high-performance computing for improved operational efficiency. |

| Border Control | Infineon Technologies, STMicroelectronics | Infineon supplies secure microcontrollers for border control applications, ensuring the security and integrity of data. The latest generation of ST’s image sensors, which improve facial recognition, have been proven in high-security environments. |

| Sustainability | Texas Instruments, Analog Devices | Energy-efficient chips from Texas Instruments help to reduce power consumption and thus help achieve sustainable development goals. Analog Devices is introducing new, more sustainable production methods for the manufacture of its chips. |

| Passenger Experience | Broadcom, MediaTek | It is a question of a large number of passengers wishing to be able to use the Internet while they are on board, and Broadcom’s chips are a major factor in this. MediaTek’s solutions are fully integrated into in-flight systems and provide seamless access to digital services, thus illustrating the company’s focus on passenger engagement. |

Conclusion: Navigating the Competitive IC Landscape

The IC market in 2023 is characterised by an extremely competitive and fragmented market, with both established and new entrants vying for market share. The geographical trend is towards Asia-Pacific as the manufacturing hub, while North America and Europe focus on innovation and sustainability. Artificial intelligence, automation and flexibility are the key success factors for IC suppliers. The established players are strengthening their positions with alliances and acquisitions, while new entrants are disrupting the market with agile solutions and sustainable practices. In this constantly evolving market, the ability to integrate new technology and be flexible in production will be a decisive factor in maintaining a leading position.

Leave a Comment