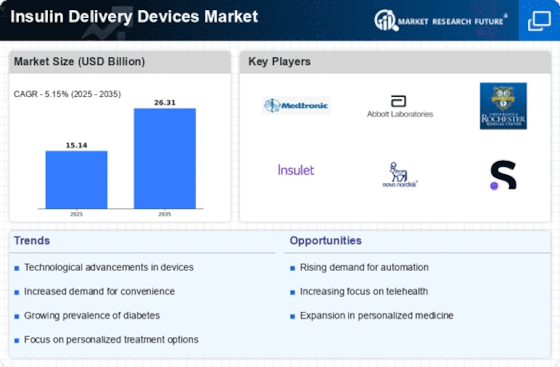

Rising Prevalence of Diabetes

The increasing incidence of diabetes worldwide is a primary driver for the Insulin Delivery Devices Market. According to recent statistics, the number of individuals diagnosed with diabetes is projected to reach approximately 700 million by 2045. This surge in diabetes cases necessitates effective management solutions, thereby propelling the demand for insulin delivery devices. As patients seek more efficient and user-friendly options, manufacturers are innovating to meet these needs. The growing awareness of diabetes management and the importance of insulin therapy further contribute to the expansion of the market. Consequently, the rising prevalence of diabetes is likely to continue influencing the Insulin Delivery Devices Market significantly.

Increased Investment in Diabetes Research

The surge in investment for diabetes research and development is a critical driver for the Insulin Delivery Devices Market. Governments and private organizations are allocating substantial funds to develop innovative solutions for diabetes management. This financial support is fostering advancements in insulin delivery technologies, leading to the introduction of more effective and efficient devices. Furthermore, collaborations between research institutions and manufacturers are becoming more common, facilitating the rapid translation of research findings into market-ready products. As a result, the influx of investment in diabetes research is likely to enhance the growth trajectory of the Insulin Delivery Devices Market.

Growing Demand for Home Healthcare Solutions

The shift towards home healthcare solutions is a notable trend impacting the Insulin Delivery Devices Market. Patients are increasingly opting for at-home management of their diabetes, driven by the desire for convenience and autonomy. This trend has led to a rise in the demand for portable and user-friendly insulin delivery devices that can be used outside clinical settings. Market data suggests that the home healthcare segment is expected to grow significantly, with a projected CAGR of over 10% in the coming years. This growth is indicative of a broader movement towards personalized healthcare, where patients prefer managing their conditions in the comfort of their homes, thereby influencing the Insulin Delivery Devices Market.

Technological Advancements in Delivery Systems

Technological innovations are transforming the Insulin Delivery Devices Market, enhancing the efficacy and convenience of insulin administration. Recent advancements include the development of smart insulin pens, continuous glucose monitors, and automated insulin delivery systems. These devices not only improve patient adherence but also provide real-time data for better glucose management. The integration of mobile applications with insulin delivery devices allows for personalized treatment plans, which is increasingly appealing to patients. As technology continues to evolve, the market is expected to witness a surge in demand for these advanced delivery systems, indicating a promising future for the Insulin Delivery Devices Market.

Rising Awareness and Education on Diabetes Management

The increasing awareness and education surrounding diabetes management are pivotal in shaping the Insulin Delivery Devices Market. Educational initiatives aimed at both healthcare professionals and patients are promoting better understanding of diabetes and the importance of insulin therapy. As awareness grows, patients are more likely to seek out effective insulin delivery solutions, driving market demand. Additionally, healthcare providers are emphasizing the need for proper diabetes management, which includes the use of advanced insulin delivery devices. This heightened focus on education and awareness is expected to contribute positively to the growth of the Insulin Delivery Devices Market.