Insect Snacks Size

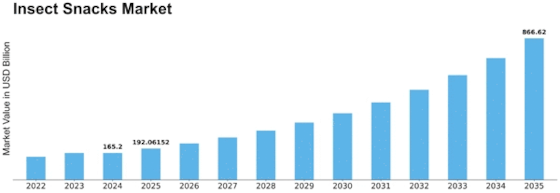

Insect Snacks Market Growth Projections and Opportunities

The Insect Snack market is in a position where it is affected by numerous different components that on the whole ultimately determines its performance and dynamics. A key factor here is the growing interest in sustainability and searching for alternatives with regard to protein sources due to rising awareness. Insect snacks, that would be generally made of crickets, mealworms, and other edible insects, have moved forward as a contributing source of protein and ecologically-wise option to consumers. Given that the interest into the ecological footprint of standard livestock farming elevates, people are increasingly consuming a variety of insect snacks as the ecologically sound protein alternative. Along with insects, the worldwide market for snacks is expected to see a rapid growth in the coming future due to the continued acceptance of eating insects and the inclusion of insect-based ingredients in snack form.

The surge of interest in insect snacks can be linked to a rising awareness about the resourcefulness as well as the high nutrition assets of insects, and thus their consideration as an alternative protein option to fulfill nutritional needs of communities. The growing class of consumers is eager to try on new and eco-friendly food alternatives therefore this insect snacks market is opening up the chances to develop new tastes.

The growth forecast underlines actual shifts in both the global and national culture of food, as edible insect snacks gain sales world-wide as both a new and a conventional dietary protein source. The influence of insects being part of daily diet is clearly seen when some companies make insect snacks where their demand was supposed to rapid expand shortly. This direction goes along with the turning consumers trend that concerns both the health choice wild and the environmental practice. This emphasizes a great role for insect snacks in the shape of the snack industry on global level. Both Insect Snacks market and the economic factors are undergoing significant influence from the economic factors. It's Challenging to Offer Affordable and Accessible Insect-Based Snacks Highlighting, the fact that processing insects might be cost-effective also can influence the price of these snacks. Just like the economic conditions (income, inflation) defines the total demand for other products on the market, the economics of the insect snacks is in the same basket as well. One of the underlying points of the insect snacks’ affordability against their traditional protein sources replacement may be just the reason for the consumer adoption.

Maintenance of sustainability is noted as a significant factor with the overall Insect Snacks market. Insect are high converter protein from feeding and latter need fewer resource like land, water and feed comparing to traditional farm animals. — Leading brands that stress sustainability of insect patties and their simple polluting footpaths are well disposed to be liked by the eco-friendly customers, this forthwith influencing the markets selection.

Leave a Comment