Market Analysis

In-depth Analysis of Inhalation Anesthesia Market Industry Landscape

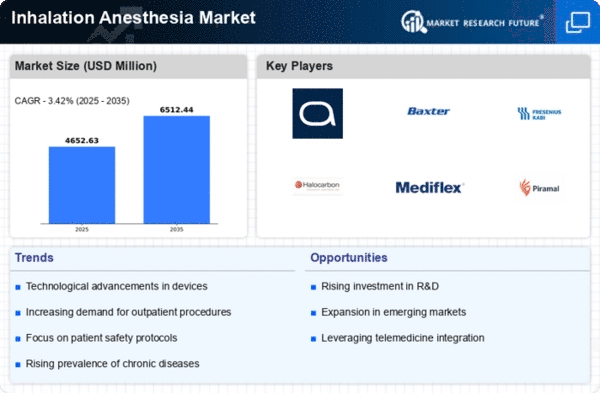

The Inhalation Anesthesia Market is a vital component of the healthcare industry, focusing on the administration of anesthesia through inhalation for various medical procedures. This market plays a crucial role in ensuring patient comfort and safety during surgeries and other medical interventions. The inhalation anesthesia’s market dynamics is largely affected by the raise for surgery across different nations around the world. Technological innovations in the form of precision vaporizers and high-tech delivery system, aids in the market growth as well. The major pharonas and health care companies are active player in the market of Inhalation Anesthesia. These organizations over-capitalize on Research & Development to launch newer products while designing market dynamics that are competitively attractive. Innovations in the surgical techniques along with rise in geriatric popula¬tion; increases prevalence of chronic diseases requiring surgical treatment such as cardiovascular and bronchial disorders, which requires pharmacological anesthesia, fuels growth of the global market. The changes showcased in the demographic trends have raised the demand of anesthesia services that contribute to market tendencies. Stringent regulatory and standard requirements control the manufacture, distribution of Food and Drug Administration approved inhalation anesthesia solutions. Players of the market have to stick to these regulations, and their influence on product development approvals processes, mode of entry to the market are crucial. The areas that focus on patient security and its care in the industry of inhalation anesthesia can be considered as one of essential priorities. It is manifested in unbroken attempts made by the companies to upgrade safety profile of their products with minimal side effects and greater patient benefits. The collaboration and joint venture in the Inhalation Anesthesia area are partly by means of merger agreements that exist between pharmaceutical firms, health care units, institutions and medical research companies. These alliances impose innovation, promote market growth rate and encourage a strategic partnering framework that deals with healthcare challenges. A considerable number of market dynamic forces, however, suffer disadvantages in the form of factors relating to accessibility of a cheaper substitute for inhalation anesthesia. In turn, economic considerations and limited resource budgets in healthcare systems are further drivers of the market dynamics related to adoption policy regarding inhalation anesthesia. Major trends in the anesthesia market leaving low-flow anesthesia systems, focus on eco -friendly agent and computerized digitisation of system to control dose. The trends underpin the market and are also shaping the future product development strategies. The future of the inhalation anesthesia market appears promising, driven by ongoing research, technological advancements, and the increasing global burden of surgical procedures. Market players are expected to continue investing in innovation and strategic collaborations to address evolving healthcare needs.

Leave a Comment