Market Analysis

In-depth Analysis of Inertial Navigation System Market Industry Landscape

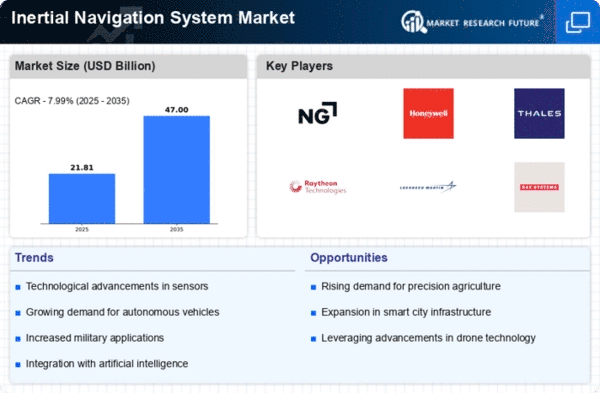

The Inertial Navigation System (INS) market is witnessing steady growth, influenced by various factors that shape its market dynamics. INS is a navigation technology that provides accurate position, velocity, and attitude information by integrating data from inertial sensors such as accelerometers and gyroscopes. One of the primary drivers of this market is the increasing demand for precise navigation and guidance systems across various industries. INS finds applications in sectors such as aviation, maritime, defense, automotive, and robotics, where accurate positioning and orientation data are crucial for mission success. The growing need for reliable navigation solutions in dynamic and GPS-denied environments drives the adoption of INS technology, fueling market growth.

Moreover, advancements in sensor technology and miniaturization are driving market dynamics in the INS sector. Innovations in MEMS (Micro-Electro-Mechanical Systems) technology have led to the development of smaller, lighter, and more cost-effective inertial sensors with improved performance and reliability. These advancements have made INS technology more accessible and affordable, expanding its application scope across a wide range of platforms and industries. Additionally, the integration of complementary sensors such as GNSS (Global Navigation Satellite System), magnetometers, and barometers enhances the accuracy and robustness of INS systems, driving demand for integrated navigation solutions tailored to specific user requirements.

Furthermore, the increasing adoption of autonomous vehicles and unmanned systems is fueling demand for INS technology. Autonomous vehicles, drones, robots, and unmanned aerial vehicles (UAVs) rely on accurate positioning and orientation data for safe and precise operations. INS technology provides these platforms with reliable navigation information independent of external references such as GPS, enabling autonomous navigation in GPS-denied environments or during signal interruptions. The proliferation of autonomous systems across industries such as transportation, agriculture, logistics, and defense drives market growth for INS solutions and encourages innovation in navigation technologies to meet the evolving needs of autonomous applications.

Moreover, the defense and aerospace sectors are significant drivers of market dynamics in the INS sector. Military platforms such as aircraft, ships, submarines, armored vehicles, and missiles rely on INS technology for navigation, guidance, and targeting purposes. The increasing focus on modernizing defense systems, enhancing situational awareness, and improving weapon accuracy drives demand for advanced INS solutions with enhanced performance, reliability, and survivability. Additionally, space exploration missions and satellite platforms require high-precision INS technology to navigate and control spacecraft during orbital maneuvers and interplanetary missions, presenting opportunities for INS manufacturers to collaborate with space agencies and aerospace companies on cutting-edge navigation systems.

However, market dynamics in the INS sector also face challenges such as cost constraints, integration complexities, and competition from alternative navigation technologies. Developing and manufacturing high-precision INS systems requires significant investment in research and development, testing, and validation processes, which can be costly and time-consuming. Additionally, integrating INS technology with other navigation sensors and systems such as GNSS, radar, and vision-based systems poses technical challenges related to synchronization, calibration, and data fusion. Moreover, competition from emerging navigation technologies such as LiDAR, visual SLAM (Simultaneous Localization and Mapping), and deep learning-based algorithms presents alternatives to traditional INS solutions, challenging INS manufacturers to innovate and differentiate their offerings to maintain market competitiveness.

Leave a Comment