- Global Market Outlook

- In-depth analysis of global and regional trends

- Analyze and identify the major players in the market, their market share, key developments, etc.

- To understand the capability of the major players based on products offered, financials, and strategies.

- Identify disrupting products, companies, and trends.

- To identify opportunities in the market.

- Analyze the key challenges in the market.

- Analyze the regional penetration of players, products, and services in the market.

- Comparison of major players’ financial performance.

- Evaluate strategies adopted by major players.

- Recommendations

- Vigorous research methodologies for specific market.

- Knowledge partners across the globe

- Large network of partner consultants.

- Ever-increasing/ Escalating data base with quarterly monitoring of various markets

- Trusted by fortune 500 companies/startups/ universities/organizations

- Large database of 5000+ markets reports.

- Effective and prompt pre- and post-sales support.

Market Size Snapshot

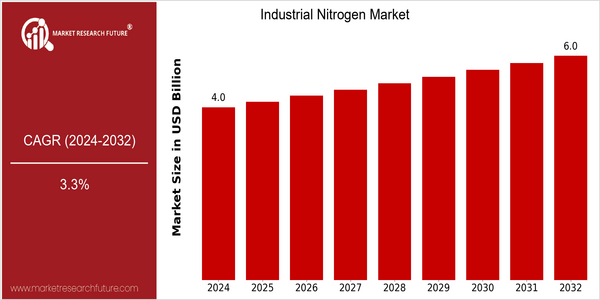

| Year | Value |

|---|---|

| 2024 | USD 4.03 Billion |

| 2032 | USD 5.97 Billion |

| CAGR (2024-2032) | 3.3 % |

Note – Market size depicts the revenue generated over the financial year

The industrial nitrogen market is growing steadily. In 2024, the market size is expected to reach $ 4.03 billion and by 2032, it is expected to reach $ 5.97 billion. This growth rate is equivalent to a CAGR of 3.3% from 2024 to 2032. This market growth is mainly due to the growing demand for nitrogen in various applications, such as food preservation, pharmaceuticals, and the manufacture of electric equipment, where nitrogen is indispensable for inert atmospheres and the prevention of oxidation. Also, the development of nitrogen production technology, in particular the development of air separation and the emergence of sustainable practices, will contribute to the growth of the market. The leading companies in this field are Air Products and Chemicals, Inc., The Linde Group, and Praxair, Inc. These companies have been active in joint ventures and investments to increase their production capacity and market share. Moreover, the nitrogen industry is shifting to sustainable practices. For example, the recent establishment of a nitrogen collaboration network to improve nitrogen supply chains and reduce the carbon footprint will further support the market.

Regional Market Size

Regional Deep Dive

Industrial nitrogen is in demand in a number of industries, such as food and beverage, pharmaceuticals, and electronics. The inert gas properties of nitrogen make it a suitable medium for various applications. Industrial nitrogen demand is affected by industrial growth, regulatory frameworks, and technological advancements. It is expected that the market will continue to grow, as industries continue to adopt nitrogen for cost-effective and efficient use in processes such as packaging, sterilization, and inerting.

Europe

- Europe is experiencing significant growth in the industrial nitrogen market, driven by stringent food safety regulations that necessitate the use of nitrogen in food packaging to prevent spoilage.

- Key players such as Linde plc and Air Liquide are investing in advanced nitrogen generation technologies, including membrane and cryogenic methods, to meet the rising demand while adhering to environmental regulations.

Asia Pacific

- The Asia-Pacific region is rapidly expanding its industrial nitrogen market, primarily due to the growth of the manufacturing sector, particularly in countries like China and India, where nitrogen is essential for various industrial applications.

- Innovations in nitrogen production, such as the development of on-site nitrogen generation systems by companies like Praxair, are making nitrogen more accessible and cost-effective for local industries.

Latin America

- Latin America is seeing a gradual increase in the industrial nitrogen market, with Brazil leading the way due to its agricultural sector's reliance on nitrogen for fertilizers and crop preservation.

- The region is also witnessing collaborations between local companies and international players, such as the partnership between White Martins and Air Products, to enhance nitrogen supply chains and production capabilities.

North America

- The North American market is witnessing a surge in demand for industrial nitrogen due to the booming food and beverage sector, which increasingly relies on nitrogen for packaging and preservation to extend shelf life.

- Recent regulatory changes aimed at reducing greenhouse gas emissions have prompted companies like Air Products and Chemicals, Inc. to innovate in nitrogen production technologies, focusing on sustainability and efficiency.

Middle East And Africa

- In the Middle East and Africa, the industrial nitrogen market is influenced by the oil and gas sector, where nitrogen is used for enhanced oil recovery and pipeline inerting, driving demand in this region.

- Government initiatives aimed at diversifying economies, such as Saudi Arabia's Vision 2030, are encouraging investments in industrial gases, including nitrogen, to support non-oil sectors.

Did You Know?

“Did you know that nitrogen makes up about 78% of the Earth's atmosphere, yet it is often underutilized in various industrial applications despite its abundance?” — National Oceanic and Atmospheric Administration (NOAA)

Segmental Market Size

In the meantime, the industrial nitrogen market has been growing steadily, mainly because of its essential role in such diverse fields as food preservation, chemical manufacture, and metal fabrication. It is also used in fertilizers, which are of vital importance to agriculture. Also, the increasingly strict regulations on industrial emissions are pushing demand for nitrogen as a cleaner substitute for other substances. In the United States, the industrial nitrogen market is at a mature stage, and such companies as Air Products and Chemicals, Inc. and The Linde Group plc are at the forefront of innovation. North America and Europe are particularly important in the nitrogen-using industries such as pharmaceuticals and electronics. In the Japanese market, the main uses of nitrogen are inerting food-packaging processes and improving the quality of steelmaking. In view of the current trends in the market, such as the demand for sustainable development and the advances in nitrogen-generation technology, including cryogenic distillation and membrane separation, the future of the industrial nitrogen market seems to be assured.

Future Outlook

The market for industrial nitrogen is expected to grow steadily between 2024 and 2032. It is expected to rise from $4.031 billion to $ 5.971 billion, with a CAGR of 3.3%. This growth will be driven by the growing demand for nitrogen in several applications, such as food preservation, pharmaceuticals, and the manufacture of electrical equipment. Moreover, as industries are increasingly adopting the principles of energy conservation and sustainability, the use of nitrogen in processes such as inerting and blanketing is expected to rise, thereby increasing the penetration of nitrogen in the market. In the long run, nitrogen will account for approximately 15% of the total gas consumption in the key industries, mainly due to the technological developments and regulatory support for the clean production of nitrogen. The development of nitrogen production techniques such as membrane separation and pressure swing adsorption will also be an important factor in the growth of the market. The upcoming regulations on carbon dioxide emissions will also encourage the use of nitrogen in various industrial processes. Besides, the integration of nitrogen in the applications of renewable energy and the growing importance of food safety and quality will also play a significant role in the growth of the market. The industrial nitrogen market will be highly dynamic in the coming years. As a result, the companies operating in the market will have to adapt to the changing market trends and customer preferences, and be prepared to seize the opportunities that will be created.

Covered Aspects:| Report Attribute/Metric | Details |

|---|---|

| Growth Rate | 7.1% (2023-2030) |

Industrial Nitrogen Market Highlights:

Leading companies partner with us for data-driven Insights

Kindly complete the form below to receive a free sample of this Report

Tailored for You

- Dedicated Research on any specifics segment or region.

- Focused Research on specific players in the market.

- Custom Report based only on your requirements.

- Flexibility to add or subtract any chapter in the study.

- Historic data from 2014 and forecasts outlook till 2040.

- Flexibility of providing data/insights in formats (PDF, PPT, Excel).

- Provide cross segmentation in applicable scenario/markets.