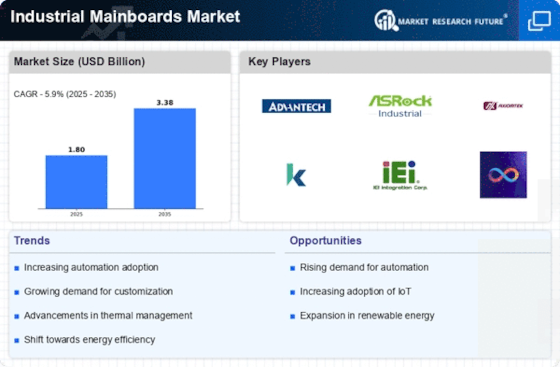

Market Trends

Key Emerging Trends in the Industrial Mainboards Market

The Industrial Mainboards Market is witnessing several notable trends that are shaping its current landscape. One prominent trend is the increasing demand for edge computing solutions. As industries adopt IoT and Industry 4.0 technologies, there is a growing need for industrial mainboards that can support edge computing capabilities. These mainboards facilitate real-time data processing at the source, reducing latency and enhancing the efficiency of industrial processes. Manufacturers are responding to this trend by developing mainboards with enhanced computing power and connectivity options to meet the requirements of edge computing applications.

Another significant trend in the industrial mainboards market is the rise of ruggedized and durable solutions. Industries such as manufacturing, transportation, and energy often operate in harsh environments that expose equipment to extreme temperatures, vibrations, and moisture. As a result, there is an increasing demand for industrial mainboards designed to withstand these challenging conditions. Manufacturers are incorporating rugged features such as reinforced components, protective coatings, and extended temperature ranges to address the need for robust and reliable solutions in industrial settings.

The move towards smaller form factors is a noteworthy trend in the industrial mainboards market. With the miniaturization of industrial devices and equipment, there is a demand for compact mainboards that can fit into space-constrained environments. Small form factor industrial mainboards offer versatility in deployment, making them suitable for applications where space is a critical consideration. Manufacturers are responding by designing mainboards with reduced dimensions without compromising on performance or functionality, catering to the trend of compact and space-efficient industrial solutions.

Connectivity is a key focus in current market trends for industrial mainboards. As industries embrace the concept of the Industrial Internet of Things (IIoT), there is a growing emphasis on connectivity features in industrial mainboards. The ability to seamlessly integrate with other devices, sensors, and networks is essential for creating interconnected industrial ecosystems. Manufacturers are incorporating a variety of connectivity options such as Ethernet, Wi-Fi, Bluetooth, and specialized industrial protocols to meet the diverse connectivity requirements of modern industrial applications.

Artificial Intelligence (AI) integration is emerging as a transformative trend in the industrial mainboards market. AI technologies, including machine learning and computer vision, are being integrated into industrial processes to enhance automation, predictive maintenance, and overall efficiency. Industrial mainboards with AI capabilities can support the processing power and data requirements of these advanced applications. Manufacturers are incorporating AI-friendly features, such as GPU support and dedicated AI accelerators, to cater to the increasing demand for intelligent industrial solutions.

Security is a paramount concern in the industrial mainboards market, leading to a notable trend in the integration of robust cybersecurity features. As industrial systems become more connected, the risk of cybersecurity threats increases. Industrial mainboards with built-in security measures, such as secure boot, hardware-based encryption, and tamper-resistant components, are becoming increasingly sought after. Manufacturers are prioritizing cybersecurity features to ensure the integrity and safety of industrial processes and data.

Green and sustainable practices are influencing market trends in the industrial mainboards sector. With a growing focus on environmental responsibility, there is an increasing demand for energy-efficient and eco-friendly solutions. Industrial mainboards with low power consumption, energy-efficient components, and compliance with environmental standards are gaining traction. Manufacturers are aligning their product development strategies with sustainability goals to meet the preferences of environmentally-conscious industries and consumers.

Leave a Comment