Top Industry Leaders in the Industrial Machinery Equipment Tools Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the Industrial Machinery Equipment Tools industry are:

Caterpillar Inc.

Deere & Company

Mitsubishi Heavy Industries, Ltd.

Siemens AG, ABB Ltd.

General Electric Company

Komatsu Ltd.

CNH Industrial N.V.

Atlas Copco AB

Hitachi, Ltd.

Sandvik AB

Manitowoc Company, Inc

Bridging the Gap by Exploring the Competitive Landscape of the Industrial Machinery Equipment Tools Top Players

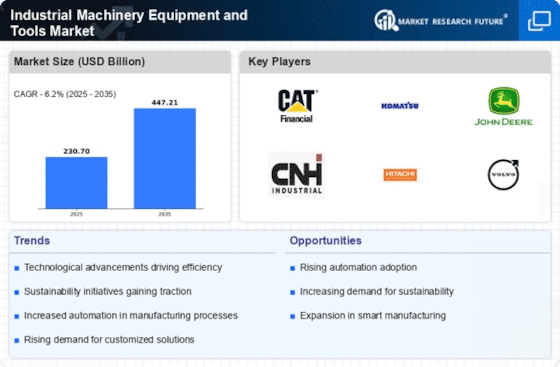

The industrial machinery, equipment, and tools market is a behemoth fueled by ever-evolving manufacturing demands and infrastructure projects. This vast landscape, however, is not a homogenous one, but a battlefield where diverse players jostle for market share. Understanding the competitive landscape is crucial for both established giants and aspiring entrants.

Key Players and Their Strategies:

The market boasts a mix of established titans like Caterpillar, John Deere, and Siemens, alongside regional players and niche specialists. Each player adopts distinct strategies to carve their niche:

- Global Expansion: Heavy hitters like Caterpillar and Komatsu leverage their vast resources and brand recognition to expand geographically, capturing markets in developing economies.

- Product Diversification: Companies like ABB and Mitsubishi Heavy Industries are diversifying their offerings beyond traditional machinery, venturing into automation solutions and digital services.

- Strategic Acquisitions: Mergers and acquisitions are a common tactic, allowing players to access new technologies, markets, and customer bases. For example, Atlas Copco's acquisition of Chicago Pneumatic further strengthened its position in the compressed air tools segment.

- Innovation and R&D: The race for technological supremacy is fierce, with players like Siemens and General Electric investing heavily in R&D to develop intelligent, energy-efficient, and Industry 4.0-compliant machinery.

Factors Influencing Market Share Analysis:

Analyzing market share in this complex landscape requires careful consideration of several factors:

- Product Portfolio: Breadth and depth of offerings play a crucial role, with companies like Sandvik catering to specific niche segments like metal cutting, while others like Bosch offer a wider range of general industrial tools.

- Geographic Presence: Market share varies significantly across regions. Asian giants like Komatsu dominate their home turf, while European players like Bosch hold sway in mature markets.

- Brand Reputation and Customer Loyalty: Established brands like John Deere enjoy strong customer loyalty, while newer players rely on competitive pricing and innovative solutions to gain traction.

- Distribution Network and After-Sales Service: A robust distribution network and prompt after-sales service are crucial for customer satisfaction and market share retention.

New and Emerging Trends Shaping the Future:

The industrial machinery landscape is constantly evolving, with several trends shaping the future:

- Industry 4.0 and Automation: Integration of IoT, robotics, and AI is transforming the industry, with companies like ABB and Siemens offering automation solutions and connected equipment.

- Focus on Sustainability: Environmental regulations and rising energy costs are driving demand for energy-efficient and eco-friendly machinery. Companies like Caterpillar are developing hybrid and electric construction equipment.

- Digitalization and Predictive Maintenance: Data-driven solutions for predictive maintenance and remote monitoring are gaining traction, with companies like GE offering software platforms and analytics services.

- Rise of Rental and Service Models: The shift from ownership to usage-based models is gaining momentum, with companies like Atlas Copco offering rental fleets and equipment-as-a-service solutions.

Competitive Scenario: A Dynamic Playing Field:

The industrial machinery market is a dynamic landscape, with constant jostling for dominance. Established players face the challenge of adapting to new technologies and changing customer needs, while new entrants must find ways to differentiate themselves and build brand recognition. Collaboration and partnerships are becoming increasingly common, with players across the value chain joining forces to develop and deliver innovative solutions.

Understanding the competitive landscape, key player strategies, and emerging trends is crucial for navigating this complex market. By adapting to the changing dynamics and leveraging innovative solutions, companies can secure their position in this ever-evolving industrial ecosystem.

Latest Company Updates:

Caterpillar Inc. (CAT):

- Jan 17, 2024: Announced a partnership with Microsoft to develop autonomous mining solutions aimed at increasing efficiency and safety (Caterpillar press release).

Deere & Company (DE):

- Oct 25, 2023: Introduced new X9 autonomous tractor prototype at Farm Progress Show (Deere & Company website).

Mitsubishi Heavy Industries, Ltd. (MHI):

- Nov 1, 2023: Acquired Swiss robotics company YASKAWA, expanding its industrial automation capabilities (Mitsubishi Heavy Industries website).

Siemens AG (SIE):

- Jan 11, 2024: Signed a multi-year agreement with Shell to accelerate industrial decarbonization projects (Siemens press release).

ABB Ltd. (ABB):

- Jan 12, 2024: Partnered with Volvo Cars to develop electric vehicle charging infrastructure solutions (ABB press release).