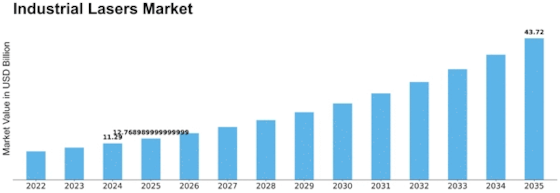

Industrial Lasers Size

Industrial Lasers Market Growth Projections and Opportunities

The industrial lasers market is an area portrayed by its dynamic and quick development, which is impacted by different market factors that add to its turn of events and development. On the market, technological advancements are a significant driver. Industrial lasers are becoming more adaptable, productive, and economical as laser technology advances continuously. Broad execution is being moved by these advancements in the assembling, auto, medical services, and gadgets areas, among others. Moreover, worldwide financial patterns fundamentally affect the industrial laser market. Improved interests in assembling, foundation, and innovative work are animated by monetary extension and strength; As a result, the demand for industrial lasers rises as a result of these factors. In actuality, times of monetary withdrawal could bring about an epistemological stop of venture action, consequently applying an effect on the development of the market. Administrative elements apply a significant effect available for modern lasers. Natural worries and rigid security guidelines are convincing makers to foster lasers that meet these necessities. Adherence to administrative guidelines ensures the security of modern methodology as well as works with market development through the foundation of trust among conclusive purchasers. The auto area is a huge market driver for modern lasers. The car business' developing spotlight on exact creation has prompted the far-reaching use of modern lasers for stamping, welding, and cutting tasks. The car business' rising interest for lightweight materials intensifies the need for complex laser innovations. The medical care area is progressively perceived as a significant driver of the modern laser market's development. In dermatology, dental procedures, and eye interventions, the utilization of laser technologies is on the rise. Because of their precision and non-nosy nature, lasers are the favoured choice in the medical services industry, which animates market development. The industrial laser market's dynamics are significantly influenced by geographical factors. Market development is regularly influenced by local financial circumstances, levels of industrialization, and the predominance of critical market members. Created locales, including North America and Europe, tend to be early adopters of complex laser innovations, though the quick industrialization in Asia-Pacific is a consider the development of the market all in all. Industrial laser deployment is significantly influenced by cost considerations. With the movement of innovation and the smoothing out of assembling processes, it is guessed that the cost of modern lasers will reduce. This cost decrease will probably support little and medium-sized organizations to execute the item to a greater extent, consequently growing the market. The modern laser area is described by extraordinary market contest, as numerous members try to achieve an upper hand. Innovative work is widely subsidized by organizations to enhance and separate their items. As organizations try to extend their product offerings and upgrade their market presence, key associations, consolidations, and acquisitions also impact the cutthroat climate.

Leave a Comment