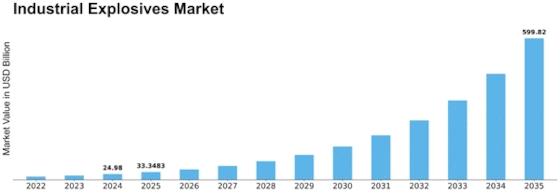

Industrial Explosives Size

Industrial Explosives Market Growth Projections and Opportunities

In the Industrial Explosives market as a whole, there are many things that can change. This market is very important for many industries, from farming to building. The demand, supply, and general security of the market for industrial explosives are all affected by these things, such as safety rules, economic uncertainty, and new technologies. All of these things are important in these different ways. Industrial explosives are very important in the building and mining industries. Extracting rocks and cutting stones into pieces are two examples of jobs that need explosives. Changes in these industries have an immediate effect on the need for industrial explosives. These changes then have an effect on market trends. There are strict safety rules and compliance standards set by the government that affect how industrial explosives are made, stored, and moved. Safety rules must be followed at all times for the business as a whole to remain credible and last. This has to be done by law, but that's not all it is. Making explosives safer, more efficient, and better for the environment are the main reasons why explosives production technology is changing. Industrial explosives are safer to work with and set off now that they have been made with better ingredients and manufacturing methods. Most of the people who use industrial explosives work in mining, building, the military, and other similar fields. The whole market is affected by changes in demand from various businesses, which can be caused by things like the need to get supplies or worries about politics. The industrial explosives business for military uses is driven by geopolitical worries and the need for defense. When the government buys explosives for military use, both defense funds and strategy worries come into play. The price of the major raw materials utilized to make industrial explosives, like ammonium nitrate, affects its costs. The price of industrial explosives changes when the cost of raw materials does. This makes the market less competitive. To run the market smoothly, companies that make, store, and move industrial explosives need to get the right licenses and approvals from the government. If there are issues or problems with the clearance process, it could have an impact on the market and supply chain. Explosives used in industry are being used in new ways in areas like space travel and getting resources that aren't normally found. This is creating exciting new markets. The industrial explosives business will grow and do well if it can diversify into new uses and growing markets.

Leave a Comment