Industrial Enzymes Size

Industrial Enzymes Market Growth Projections and Opportunities

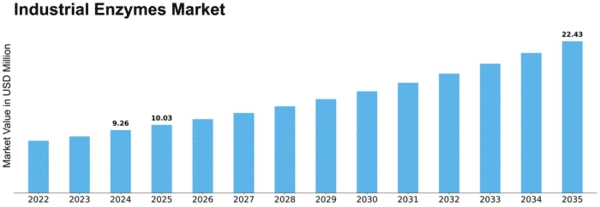

The Industrial Enzymes Market is significantly influenced by various market factors that play a crucial role in shaping its dynamics. One of the primary drivers of this market is the increasing demand for sustainable and eco-friendly solutions in various industries. As industries strive to minimize their environmental impact, the adoption of industrial enzymes has gained momentum due to their ability to enhance efficiency and reduce the need for harsh chemicals. The Global Industrial Enzymes Market, with an initial valuation of USD 7.10 million in 2022, is projected to exhibit a Compound Annual Growth Rate (CAGR) of 6.27% throughout the forecast period spanning from 2022 to 2030. This market's significant growth is attributed to the escalating demand for industrial enzymes across various sectors. Industrial enzymes serve as catalysts in biochemical processes, finding extensive applications in industries such as food and beverage, textiles, biofuels, and pharmaceuticals.

The robust CAGR reflects the increasing recognition of industrial enzymes as essential elements in optimizing manufacturing processes and enhancing product quality. Their role in improving efficiency, reducing energy consumption, and promoting sustainability aligns with the growing emphasis on eco-friendly and cost-effective industrial practices.

As industries worldwide seek innovative and sustainable solutions, the Industrial Enzymes Market is poised to be a key driver of transformative changes. The market's ascent is not only indicative of its present economic significance but also points toward a future where industrial enzymes will play a pivotal role in shaping the landscape of diverse industries, addressing the evolving needs for efficiency, sustainability, and quality in manufacturing processes. Moreover, the growing awareness about the benefits of industrial enzymes in improving production processes is fueling market growth. Enzymes are known for their catalytic properties, which can accelerate chemical reactions and enhance the overall efficiency of industrial processes. This has led to increased adoption across sectors such as food and beverages, textiles, and biofuel production.

In addition to environmental considerations, the rising demand for quality products is driving the use of industrial enzymes. Enzymes play a vital role in enhancing the quality and characteristics of various end products. In the food and beverage industry, for instance, enzymes are utilized to improve the texture, flavor, and nutritional profile of products. This demand for high-quality end products is pushing manufacturers to incorporate industrial enzymes into their production processes.

Furthermore, advancements in biotechnology and genetic engineering have opened up new avenues for innovation in the industrial enzymes market. Researchers and companies are investing in developing novel enzymes with enhanced functionalities, making them more versatile and applicable across different industries. This continuous innovation is contributing to the expansion of the industrial enzymes market as businesses seek to stay competitive and meet evolving consumer demands.

On the flip side, challenges such as regulatory constraints and high production costs can impede the growth of the industrial enzymes market. Strict regulations governing the use of enzymes in certain industries, particularly in the food sector, can create barriers for market players. Compliance with these regulations requires substantial investments in research and development to ensure that enzymes meet safety and quality standards.

Moreover, the cost of production, especially for genetically modified enzymes, can be a limiting factor for widespread adoption. The initial investment in developing and producing enzymes using advanced biotechnological methods can be high, impacting the overall pricing of these enzymes in the market. However, as technology advances and economies of scale come into play, it is expected that the cost of production will decrease, making industrial enzymes more accessible to a broader range of industries.

Leave a Comment