Industrial Endoscope Size

Industrial Endoscope Market Growth Projections and Opportunities

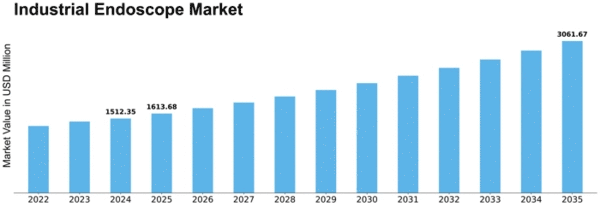

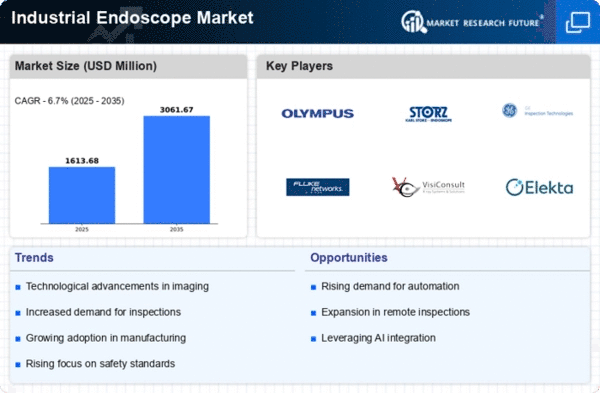

The industrial endoscope market is experiencing significant growth due to its widespread adoption across various industries for inspection and maintenance purposes. This market is driven by factors such as rapid technological advancements, increased demand for non-destructive testing, and the need for efficient and cost-effective diagnostic tools.

The industrial endoscope, originally designed for medical applications, has found extensive utility in diverse industrial settings. Its flexible fiber-optic connections, lightweight design, and high-quality optical components make it an ideal tool for professionals in electricians, security personnel, and mechanics across different sectors. The ability to inspect and analyze machinery without dismantling it has led to faster, more accurate, and cost-effective maintenance practices.

The market is witnessing a surge in demand, primarily fueled by the growth of industries such as manufacturing, aerospace & defense, energy & power, automotive & transportation, and construction. These sectors are experiencing exponential growth, and organizations, both small and large, are increasingly adopting advanced instruments like industrial endoscopes to enhance their work processes seamlessly.

In North America, particularly in the United States, the market is thriving due to a combination of factors such as rapid innovation, early adoption of advanced technology, and robust government support. The U.S. market, holding the largest share, continues to exhibit immense potential, driven by continuous expansions in businesses and ongoing research and development activities. Canada, being a technology hub, is positioned as the fastest-growing country in the region, while Mexico, with the lowest adoption rate, is expected to witness increased adoption in various industries.

The water-resistant tube and lenses of industrial endoscopes have further expanded their applications, enabling easy examination of submerged components. The versatility of endoscopes allows them to be utilized in a wide range of settings, including industrial sectors, workshops, research laboratories, and university setups.

As industries evolve, the demand for industrial endoscopes is expected to rise steadily. Their ability to provide unique views into the internal workings of machinery and equipment makes them indispensable for preventive maintenance and quick issue identification. The cost-effectiveness of using endoscopes for inspections, compared to traditional dismantling methods, positions them as preferred tools for professionals seeking efficient solutions.

The global industrial endoscope market is highly competitive, with numerous vendors offering feature-rich and innovative solutions. Major players in the market include well-established names such as Olympus Corporation, GE Inspection Technologies, Karl Storz SE & Co. KG, and SKF Group, among others. These companies are at the forefront of technological advancements, constantly striving to provide cutting-edge solutions to meet the evolving needs of industries.

The industrial endoscope market is witnessing robust growth driven by technological innovations, increasing industry demands, and the efficiency of these tools in various applications. As industries continue to embrace advanced diagnostic instruments for inspection and maintenance, the industrial endoscope market is poised for sustained expansion, offering professionals across different sectors invaluable tools for enhanced operational efficiency and cost-effective maintenance practices.

Leave a Comment