Top Industry Leaders in the Industrial Batteries Market

Industrial Batteries Market

Industrial batteries, the silent workhorses of the modern world, pulsate with hidden potential. These powerhouse solutions propel forklifts, illuminate emergency backup systems, and power critical telecommunications infrastructure. And the global industrial battery market, is buzzing with competition as diverse players jockey for a share of this electrifying landscape. Let's delve into the strategies, factors, and trends shaping this dynamic realm.

Strategies Charging Market Share:

-

Technology Diversification: Leading players like Panasonic and Samsung are expanding beyond traditional lead-acid batteries to include lithium-ion, nickel-metal hydride, and advanced flow batteries, catering to specific performance and sustainability needs. -

Sustainability Focus: Green energy is electrifying the market. Companies like BYD are investing in research and development of lithium-iron-phosphate batteries for extended lifespans and responsible recycling practices, aligning with eco-conscious customers and regulations. -

R&D Innovation: R&D labs are sparking breakthroughs. Tesla is pioneering ultra-fast charging technologies for industrial batteries, minimizing downtime and maximizing efficiency. -

Regional Expansion: Asia-Pacific, with its booming manufacturing and renewable energy sectors, holds immense potential. Companies like LG Chem are setting up production facilities in this region to capitalize on the local demand. -

Strategic Partnerships: Collaboration strengthens the grid. For instance, Johnson Controls partnered with a renewable energy developer to design custom battery storage solutions for solar and wind power systems, bridging the gap between intermittent generation and reliable demand.

Factors Dictating Market Share:

-

Performance Prowess: Superior longevity, discharge rate, and environmental impact are crucial metrics. Established brands like EnerSys have built reputations for reliable performance, attracting loyal customers in demanding applications. -

Cost-Effectiveness: Price remains a critical factor, particularly in mature markets. Chinese manufacturers often offer lower prices, challenging established players to optimize production and pricing strategies while maintaining quality. -

Regulatory Landscape: Stringent regulations on hazardous materials and battery recycling dictate industry practices. Players who comply with these regulations, like Enersys with its closed-loop recycling processes, gain a competitive edge. -

Application Diversity: Catering to diverse industries offers resilience. Companies with broad product portfolios like Exide Technologies benefit from diversification, mitigating risks in saturated segments.

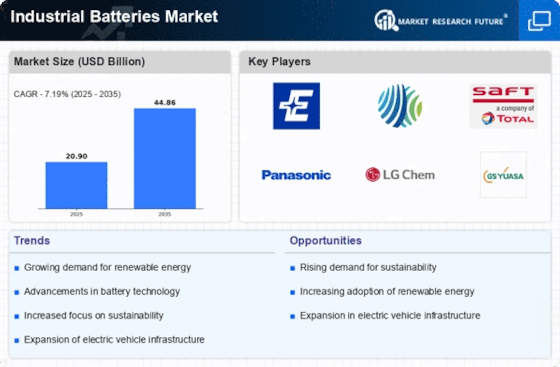

Key Players:

- Exide Technologies Inc. (India)

- Johnson Controls Inc. (U.S.)

- Enersys Inc. (U.S.)

- Saft Groupe S.A. (France)

- GS Yuasa Corporation (Japan)

- Northstar Battery Company LLC (Sweden)

- C & D Technologies, Inc. (U.S.)

- Toshiba International Corporation (Japan)

- Robert Bosch GmbH (Germany)

- East Penn Manufacturing Company (U.S.)

Recent Developments:

-

December 2021-Eternity Technologies, an eminent industrial battery developer, is about to introduce QUASAR, its latest line of Carbon Nano Motive batteries that offer more power, have extended run times and provide quicker recharge compared to the traditional lead batteries. Designed primarily for heavy-duty material handling sectors like electric forklift trucks, these industrial batteries can be completely charged in only four hours and can offer much higher flexibility than conventional batteries. QUASAR Carbon Nano motive batteries have use in material handling equipment with outdoor, and multi-shift cold storage applications with around 50% more power. QUASAR is also the perfect industrial battery for really high temperatures outdoor or indoor.

-

December 2021-Stryten Energy LLC, an energy storage solutions developer based in the US, has acquired Tulip Richardson Manufacturing (TRM), a developer of custom injection molding items serving the industrial lead battery, consumer, and automotive markets.

-

In December 2020, a subsidiary of Saft, TOTAL introduced an innovation of batteries in India.The manufacturer of the Industrial battery inverted Energy launched a new li-ion battery plant in Okhla