Top Industry Leaders in the Induction Motors Market

*Disclaimer: List of key companies in no particular order

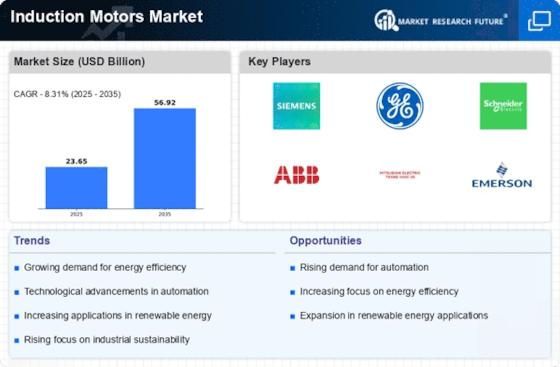

Induction motors, the workhorses of industry, hum in countless applications, from powering conveyor belts to driving air conditioners. This multi-billion dollar market is brimming with competition as established giants, regional specialists, and technology innovators vie for a share of the electric drive.

Top Companies in the Induction Motors industry includes,

Emerson Electric Company

Regal Beloit Corporation ABB Ltd.

Schneider Electric SE

Marathon Electric

Kirloskar Electric Company

Siemens AG

Baldor Electric Company and others.

Key Player Strategies:

Global Titans: Companies like ABB, Siemens, and WEG Electric Corporation leverage their extensive global reach, diverse product portfolios, and established brand reputations to maintain their dominance. They cater to a wide range of industries, offering standardized and customized motors for various applications and sizes. ABB's Dodge brand exemplifies their focus on reliability and efficiency in industrial applications.

Regional Champions: Companies like Nidec Motor Corporation in Japan and Kirloskar Electric in India excel in their specific geographic markets, boasting strong relationships with local customers and understanding of regional regulations. They offer cost-effective solutions tailored to regional needs. Nidec's emphasis on high-efficiency motors catering to Japan's strict energy regulations showcases their regional adaptation.

Technology Disruptors: Startups like Marathon Motors and Rockwell Automation are disrupting the market with cutting-edge features like intelligent motor controls, predictive maintenance capabilities, and cloud-based monitoring. They cater to tech-savvy customers seeking optimized performance and data-driven insights. Marathon's use of AI-powered analytics for predictive maintenance exemplifies their focus on next-generation solutions.

Sustainability Champions: Companies like WEG and Baldor Electric prioritize environmentally responsible practices, utilizing recycled materials, offering energy-efficient motors, and promoting responsible end-of-life motor disposal. They cater to eco-conscious consumers and leverage sustainability as a competitive advantage. WEG's focus on high-efficiency motors minimizing energy consumption showcases their commitment to green solutions.

Factors for Market Share Analysis:

Product Portfolio Breadth: Offering a diverse range of motors for various applications (industrial, agricultural, residential), power outputs, and efficiency levels broadens customer reach. Companies with comprehensive portfolios gain an edge.

Technology Innovation: Investing in R&D for energy-efficient designs, intelligent controls, and advanced materials is crucial for staying ahead of the curve and attracting tech-savvy customers. Companies leading in innovation stand out.

Cost and Affordability: Balancing advanced features with competitive pricing is vital for mass adoption, particularly in cost-sensitive industries. Companies offering cost-effective solutions without compromising quality stand out.

Reliability and Service: Ensuring long-lasting performance, efficient maintenance support, and readily available spare parts is essential for building trust and customer loyalty. Companies with strong after-sales networks gain an edge.

New and Emerging Trends:

Integration with Smart Grids: Connecting motors to smart grids allows for optimized energy management, demand response capabilities, and grid stability improvements. Companies offering smart grid compatible solutions cater to the evolving energy landscape.

Focus on Industry 4.0: Integrating motors with industrial automation platforms, sensors, and data analytics enables predictive maintenance, process optimization, and remote monitoring. Companies offering Industry 4.0-ready solutions cater to the trend of interconnected factories.

Emphasis on Circular Economy: Implementing closed-loop manufacturing processes, utilizing recycled materials, and promoting motor recycling programs are gaining traction due to sustainability concerns. Companies demonstrating environmental consciousness attract eco-conscious customers and potential regulations.

Focus on Compact and High-Performance Motors: Designing smaller, lighter motors with higher power outputs caters to space-constrained applications and emerging fields like robotics and drones. Companies focusing on innovative motor design stand out.

Overall Competitive Scenario:

The induction motors market is a dynamic and complex space with diverse players employing varied strategies. Established giants leverage their reach and diverse portfolios, while regional specialists cater to specific markets. Technology disruptors introduce innovative features, and sustainability champions attract eco-conscious consumers. Factors like product portfolio, technological innovation, affordability, and service play a crucial role in market share analysis. New trends like smart grid integration, Industry 4.0, circular economy, and high-performance motors offer exciting growth opportunities. To succeed in this evolving market, players must prioritize innovation, cater to diverse customer needs, embrace sustainable practices, and explore technology-driven solutions. By aligning their strategies with market trends and customer demands, they can secure a powerful position in this ever-churning industry.

Industry Developments and Latest Updates:

Emerson Electric Company:

- October 26, 2023: Announced launch of the SynMax® High-Efficiency IE5 Permanent Magnet (PM) Synchronous Motors, aiming for improved energy efficiency in industrial applications. (Source: Emerson press release)

Regal Beloit Corporation:

- November 16, 2023: Acquired Control Products, Inc., expanding its portfolio of electric motors and controls for HVAC and refrigeration applications. (Source: Regal Beloit press release)

ABB Ltd.:

- December 12, 2023: Showcased the ABB Ability™ IntelliGear intelligent motor drive system at the Middle East Electricity exhibition, emphasizing predictive maintenance and optimized energy usage. (Source: ABB press release)

Schneider Electric SE:

- December 5, 2023: Partnered with WEG to develop and manufacture high-efficiency IE5 induction motors for the European market, focusing on sustainable solutions and reduced carbon footprint. (Source: Schneider Electric press release)

Marathon Electric:

- November 3, 2023: Announced the availability of its Marathon Severe Duty 5000 (SD5000) motor line in larger frame sizes (up to 680), catering to heavy-duty industrial applications. (Source: Marathon Electric website)

Kirloskar Electric Company:

- December 15, 2023: Received an order from the Oil and Natural Gas Corporation Limited (ONGC) for supplying high-voltage induction motors for oil and gas production platforms. (Source: Kirloskar Electric press release)