Government Initiatives and Funding

The Indian government has launched several initiatives aimed at promoting the smart city market, including the Smart Cities Mission, which aims to develop 100 smart cities across the country. This initiative has allocated around $1.5 billion for the development of urban infrastructure and services. Additionally, the government is encouraging public-private partnerships to leverage private investment in smart city projects. These initiatives are expected to create a conducive environment for innovation and investment, potentially leading to a market growth rate of 15-20% annually. The proactive stance of the government in funding and facilitating smart city projects is a crucial driver for the smart city market.

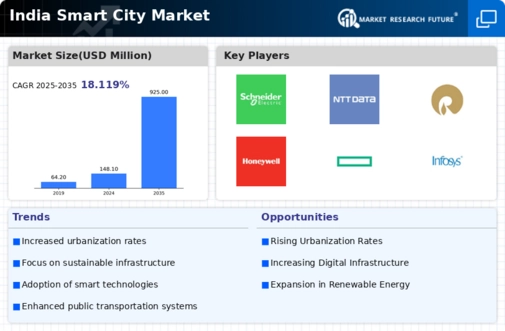

Urbanization and Population Growth

The rapid urbanization in India is a primary driver for the smart city market. With over 34% of the population currently residing in urban areas, this figure is projected to rise to 40% by 2030. This urban influx necessitates the development of smart infrastructure to manage resources efficiently. the smart city market is projected to grow significantly, with investments expected to reach approximately $30 billion by 2025. Urbanization leads to increased demand for smart solutions in transportation, waste management, and energy efficiency, thereby propelling the market forward. As cities expand, the need for integrated systems that enhance the quality of life becomes paramount, indicating a robust growth trajectory for the smart city market.

Rising Demand for Sustainable Solutions

There is a growing emphasis on sustainability within the smart city market, driven by the need to address environmental challenges. Indian cities are increasingly adopting green technologies to reduce carbon footprints and enhance energy efficiency. For example, the implementation of smart grids and renewable energy sources is expected to reduce energy consumption by 20-25% in urban areas. This shift towards sustainability is not only beneficial for the environment but also aligns with the global trend of sustainable urban development. The increasing demand for eco-friendly solutions is likely to propel the smart city market, as stakeholders seek to create resilient and sustainable urban ecosystems.

Enhanced Citizen Engagement and Services

The smart city market is driven by the need for improved citizen engagement and service delivery. With the rise of digital platforms, citizens are increasingly expecting transparent and efficient services from their local governments. Initiatives such as mobile applications for civic services and online grievance redressal systems are becoming commonplace. This shift towards digital governance is expected to enhance citizen satisfaction and participation, potentially increasing the adoption of smart city solutions. As cities strive to create more inclusive and responsive governance structures, the smart city market is likely to benefit from this trend, fostering a more engaged citizenry.

Technological Advancements in IoT and AI

The integration of Internet of Things (IoT) and Artificial Intelligence (AI) technologies is transforming the smart city market in India. These technologies enable real-time data collection and analysis, which enhances urban management and service delivery. For instance, smart traffic management systems can reduce congestion by up to 30%, improving overall urban mobility. The market for IoT in smart cities is projected to reach $10 billion by 2025, driven by the increasing adoption of smart sensors and connected devices. As cities embrace these technological advancements, the smart city market is likely to experience accelerated growth, fostering innovation and efficiency in urban environments.