Increasing Migration Trends

Migration trends significantly influence the remittance market in India. With millions of Indians residing abroad, particularly in regions such as the Middle East and North America, the flow of remittances has become a crucial economic factor. In 2025, it is estimated that Indian migrants will send back over $80 billion, contributing to the financial stability of families and communities back home. This influx of funds supports local economies and enhances the purchasing power of recipients. The remittance market is thus closely tied to migration patterns, as the number of expatriates directly correlates with the volume of remittances sent, indicating a robust and growing market.

Enhanced Financial Literacy Programs

Financial literacy initiatives are becoming increasingly important in the context of the remittance market in India. As more individuals become aware of financial products and services, they are better equipped to utilize remittance services effectively. Programs aimed at educating migrants and their families about the benefits of formal remittance channels can lead to increased usage of regulated services, which often offer lower fees and better exchange rates. In 2025, it is anticipated that financial literacy efforts will contribute to a 15% increase in the adoption of formal remittance services, thereby enhancing the overall efficiency and transparency of the remittance market.

Economic Growth and Consumer Spending

The economic growth in India plays a pivotal role in shaping the remittance market. As the economy expands, consumer spending increases, leading to higher demand for remittance services. In 2025, India's GDP growth is projected to be around 6%, which may further stimulate the remittance market. Families receiving remittances often invest in education, healthcare, and housing, thereby driving local economic development. This relationship between economic growth and remittance inflows suggests that as the economy flourishes, the remittance market is likely to benefit from increased transaction volumes and a broader range of services offered to consumers.

Technological Advancements in Payment Systems

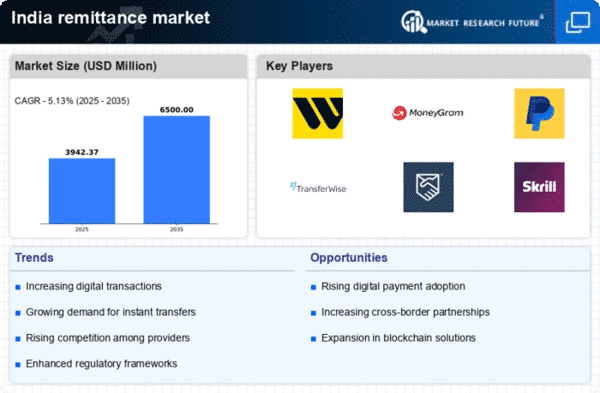

The remittance market in India is experiencing a notable transformation due to rapid technological advancements in payment systems. Innovations such as mobile wallets, blockchain technology, and real-time payment systems are enhancing the efficiency and security of cross-border transactions. For instance, the introduction of UPI (Unified Payments Interface) has streamlined domestic remittances, while international players are increasingly adopting blockchain to reduce transaction costs. As of 2025, the remittance market is projected to grow by approximately 10% annually, driven by these technological improvements. This evolution not only facilitates faster transactions but also attracts a younger demographic that prefers digital solutions, thereby expanding the customer base within the remittance market.

Competitive Landscape and Service Diversification

The competitive landscape of the remittance market in India is evolving, with numerous players entering the space. This competition drives innovation and service diversification, as companies strive to attract customers through improved offerings. In 2025, the market is expected to see a rise in value-added services such as insurance, investment options, and loyalty programs, which may enhance customer retention. The presence of both traditional banks and fintech companies creates a dynamic environment where consumers benefit from lower fees and better service quality. This competitive nature of the remittance market is likely to foster growth and adaptability, ensuring that it meets the changing needs of its clientele.