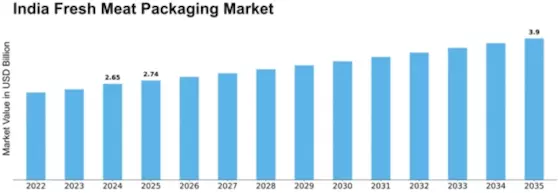

India Meat Packaging Size

India Meat Packaging Market Growth Projections and Opportunities

Indian meat packaging market is affected by a plethora of factors that contribute to the market dynamics, such as the growth in sales of processed meat products, increased disposable income, and the emphasis on product safety and quality. One of the key reasons is the fact that the population of the country is not only increasing at rates much higher than that of Western societies, but is also very fast urbanizing. With the increase of people from villages to cities, there is a greater tendency for packaging and process meat products. This has been driven by changing lifestyle needs and the need for convenience. Because of this change in the consumer behavior, meat packing industry has been flooded by the bulk order for efficent and fast product packaging.

Subsequently, the augmentation in the disposal income of the middle-class people which is the main contributor of high consumption of meat in the Indian market is another factor which results in the rapid growth of the meat packaging industry in India. In opting for higher financial means consumers will be more willing to acquire packages of premium meat products as well as with superior packaging. Hence, the meat producers are in a race with each other so as to become the most favored by the consumers who are looking for differentiated meat packaging solutions. Longer shelf life, better hygiene, and appealing presentation are now a priority among meat packaging solutions. This has led to mature improvements, which are now taking place in meat package solutions.

Along with this, The Government Regulations and initiatives too are one of the major influences in India Meat Packaging Market. The regulatory system in India is being changed quite differently, and so the food safety and hygiene code is being strengthened. There have been so many laws pertaining to the packaging of the meat products and this has consequently, led companies to chose investing in technologies for maintaining safety and integrity of packaged meats. In addition, the government efforts which aim to enhance the food processing industry in the nation have enabled the market autochthonous meat packaging market to grow as well.

The attitude of the majority of consumers to environmental issues and their desire to live a sustainable life is one of the significant factors behind the increasing demand for green energy. As a result, more eco-friendly and recyclable packaging materials have become an essential choice in a growing number of cases among firms. Companies function in the packaging industry are now investing into the development of sustainable counterparts to traditional packaging products in line with eco-issues and shifting desires of consumers. It is this transition towards inclusivity as well as growing trend of international practices that highlights the need for environmentally friendly activities, which is the driving force of consumer demand.

Along with sector competitiveness and consolidation some other factors influencing the scenario of the Indian Meat Packaging market. The competition among packaging firms is getting higher and with continuous innovations and improvement in packaging solutions, the market is witnessing the battle of organizational strength. M&A in the area has become the nature of things, as the goal to extend product assortment and operate in different geographies is now the order of the day.

Leave a Comment