Rising Healthcare Costs

The health insurance market in India is under pressure from escalating healthcare costs, which have been rising at an average rate of 12% annually. Factors contributing to this trend include advancements in medical technology, increased demand for specialized treatments, and inflation in healthcare services. As individuals face higher out-of-pocket expenses, the necessity for comprehensive health insurance becomes more pronounced. This situation compels consumers to seek insurance solutions that can mitigate financial risks associated with healthcare, thereby driving growth in the health insurance market. Insurers are responding by offering more tailored products to meet these emerging needs.

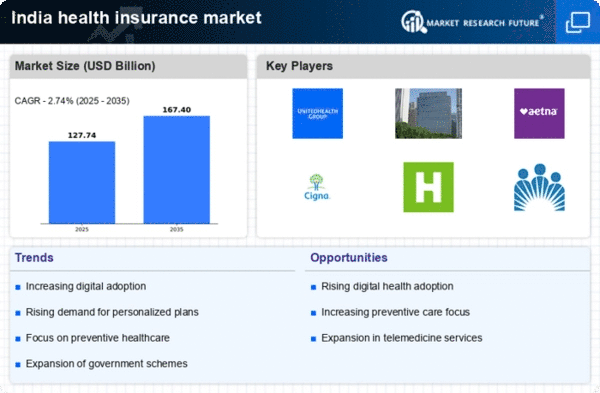

Growing Middle-Class Population

The health insurance market in India is experiencing a notable boost due to the expanding middle-class population. As of 2025, approximately 300 million individuals belong to this demographic, which is increasingly prioritizing health coverage. This shift is driven by rising disposable incomes and a greater awareness of health-related issues. The middle class is more likely to invest in health insurance products, leading to a projected growth rate of 15% annually in the market. This demographic shift not only increases demand for health insurance but also encourages insurers to innovate and diversify their offerings, thereby enhancing the overall health insurance market in India.

Government Initiatives and Schemes

The health insurance market in India is significantly influenced by various government initiatives aimed at improving healthcare access. Programs such as Ayushman Bharat, which provides coverage to over 500 million individuals, have catalyzed the growth of the health insurance market. These initiatives not only enhance public awareness but also encourage private insurers to develop affordable plans. The government's commitment to increasing healthcare spending to 2.5% of GDP by 2025 further indicates a supportive environment for the health insurance market. This proactive approach is likely to stimulate demand and foster competition among insurers.

Increased Focus on Preventive Healthcare

The health insurance market in India is witnessing a paradigm shift towards preventive healthcare. Insurers are increasingly recognizing the value of promoting wellness programs and preventive measures to reduce long-term costs. This trend is reflected in the growing number of policies that offer incentives for regular health check-ups and lifestyle management. As awareness of preventive care rises, consumers are more inclined to invest in health insurance products that emphasize these aspects. This focus not only enhances customer engagement but also contributes to the overall growth of the health insurance market, as healthier populations lead to lower claims.

Technological Advancements in Insurance Services

The health insurance market in India is being transformed by technological advancements that enhance service delivery and customer experience. Innovations such as telemedicine, mobile health applications, and AI-driven claims processing are becoming increasingly prevalent. These technologies streamline operations and improve accessibility for consumers, making it easier to obtain and manage health insurance. As of 2025, it is estimated that 60% of health insurance providers are leveraging technology to enhance their offerings. This trend not only attracts tech-savvy consumers but also positions the health insurance market for sustained growth in an increasingly digital economy.