India Fmcg Size

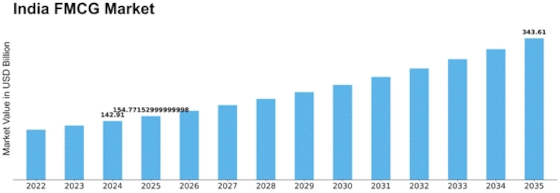

India FMCG Market Growth Projections and Opportunities

The FMCG (Fast Moving Consumer Goods) market in India is characterized by dynamic and multifaceted market dynamics driven by various factors including changing consumer preferences, demographics, economic conditions, technological advancements, and regulatory policies. One of the primary drivers of market dynamics in India's FMCG sector is its large and diverse consumer base. With a population exceeding 1.3 billion people and a growing middle class, India represents a lucrative market for FMCG companies offering a wide range of products including food and beverages, personal care items, household goods, and more. The increasing urbanization and rising disposable incomes have led to changes in consumer lifestyles and preferences, with a growing demand for convenience, quality, and value for money.

Furthermore, rapid urbanization and the expansion of modern retail channels such as supermarkets, hypermarkets, and e-commerce platforms have transformed the FMCG distribution landscape in India. Traditional mom-and-pop stores continue to play a significant role in FMCG sales, particularly in rural and semi-urban areas. However, the emergence of modern retail formats has led to increased competition, greater product visibility, and enhanced consumer shopping experiences. E-commerce platforms have also gained traction, offering convenience, accessibility, and a wide variety of FMCG products delivered directly to consumers' doorsteps.

Moreover, technological advancements and digitalization have revolutionized marketing and distribution strategies within India's FMCG market. FMCG companies are leveraging digital platforms, social media, and e-commerce channels to engage with consumers, drive brand awareness, and facilitate direct-to-consumer sales. Data analytics and artificial intelligence are increasingly being utilized to understand consumer behavior, personalize marketing campaigns, optimize supply chain operations, and enhance product innovation. Mobile applications and online platforms enable FMCG companies to reach consumers in remote areas and tailor their offerings to meet local preferences and needs.

Additionally, regulatory policies and government initiatives influence market dynamics in India's FMCG sector. The implementation of Goods and Services Tax (GST) has streamlined taxation and logistics processes, reducing barriers to interstate trade and improving supply chain efficiencies. Government schemes such as the Pradhan Mantri Ujjwala Yojana (PMUY) aimed at providing access to clean cooking fuel, and Swachh Bharat Abhiyan promoting cleanliness and sanitation, have driven demand for FMCG products such as cooking oil, hygiene products, and household cleaners. However, regulatory changes such as changes in import duties, labeling requirements, or restrictions on advertising can impact FMCG companies' operations and market strategies.

Furthermore, competitive pressures and industry consolidation are key drivers of market dynamics within India's FMCG sector. The market is characterized by intense competition among both domestic players and multinational corporations vying for market share across product categories and consumer segments. FMCG companies invest heavily in branding, advertising, and product innovation to differentiate themselves and stay ahead of competitors. Mergers, acquisitions, and strategic alliances are common strategies employed by FMCG companies to expand their product portfolios, enter new markets, and achieve economies of scale.

Socioeconomic factors such as income levels, cultural preferences, and regional diversity also influence market dynamics in India's FMCG sector. FMCG companies must navigate diverse consumer preferences and purchasing behaviors across different states, languages, and cultural backgrounds. Price sensitivity remains a critical factor driving purchasing decisions, particularly among lower-income segments. As a result, FMCG companies often offer products in multiple price tiers to cater to different income groups while maintaining profitability and market competitiveness.

Leave a Comment