India Electric Car Size

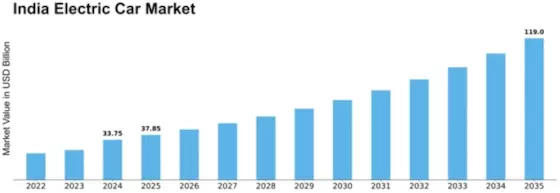

India Electric Car Market Growth Projections and Opportunities

The Indian electric car market is influenced by several key market factors that shape its growth and development. Firstly, government policies and incentives play a significant role in driving the adoption of electric vehicles (EVs). In recent years, the Indian government has implemented various initiatives to promote electric mobility, including subsidies, tax incentives, and investment in charging infrastructure. These policies aim to reduce pollution, decrease dependence on fossil fuels, and create a conducive environment for electric vehicle manufacturers and consumers.

Secondly, consumer awareness and acceptance of electric cars are crucial market factors. While there is growing awareness about the environmental benefits of EVs, concerns such as range anxiety, charging infrastructure availability, and initial costs still hinder widespread adoption. However, as technology advances and more affordable electric car models enter the market, consumer acceptance is gradually increasing. Additionally, rising fuel prices and environmental consciousness among consumers are driving interest in electric vehicles as a sustainable transportation alternative.

Thirdly, the availability and affordability of charging infrastructure are critical factors influencing the growth of the electric car market in India. Adequate charging infrastructure, including both public and private charging stations, is essential to alleviate range anxiety and facilitate convenient charging for EV owners. As the government and private entities continue to invest in expanding the charging network across the country, it will encourage more consumers to consider electric cars as a viable option for their transportation needs.

Moreover, technological advancements and innovations in battery technology are shaping the competitiveness of electric cars in the Indian market. Battery technology significantly influences factors such as vehicle range, charging time, and overall performance. As battery technology improves and becomes more cost-effective, electric vehicles become more accessible and practical for a broader range of consumers. Manufacturers investing in research and development to enhance battery efficiency and reduce costs will have a competitive edge in the evolving electric car market.

Furthermore, the regulatory environment and industry collaborations play a crucial role in shaping the landscape of the Indian electric car market. Regulatory frameworks governing emissions standards, vehicle safety, and manufacturing guidelines impact the design, production, and sale of electric vehicles. Collaborations between government bodies, automotive manufacturers, and other stakeholders are essential for addressing challenges such as infrastructure development, standardization, and policy implementation.

Additionally, market competition and the presence of established players influence the dynamics of the electric car market in India. Domestic and international automotive manufacturers are increasingly entering the electric vehicle segment, introducing a diverse range of electric car models with varying features and price points. Competition fosters innovation, improves product quality, and drives down costs, ultimately benefiting consumers and accelerating market growth.

Lastly, societal trends and demographic factors also contribute to the evolution of the electric car market in India. Urbanization, changing lifestyles, and the increasing need for sustainable transportation solutions are reshaping consumer preferences and driving demand for electric vehicles. As India's middle class expands and disposable incomes rise, there is a growing market for environmentally friendly and technologically advanced transportation options, creating opportunities for electric car manufacturers to capitalize on this trend.

In conclusion, the Indian electric car market is influenced by a combination of government policies, consumer preferences, infrastructure development, technological advancements, regulatory frameworks, market competition, and societal trends. As these market factors continue to evolve and interact, they will shape the trajectory of the electric car market, driving its growth and adoption in the coming years.

Leave a Comment