Aging Population

India's demographic shift towards an aging population is likely to have a profound impact on the dietary supplements market. As the proportion of elderly individuals increases, there is a growing demand for products that cater to age-related health concerns, such as joint health, cognitive function, and heart health. The dietary supplements market is responding to this trend by developing specialized formulations aimed at older adults. Projections indicate that the segment targeting seniors could grow by 15% annually, reflecting the need for nutritional support in this demographic. This driver underscores the importance of tailoring products to meet the specific health needs of aging consumers.

E-commerce Expansion

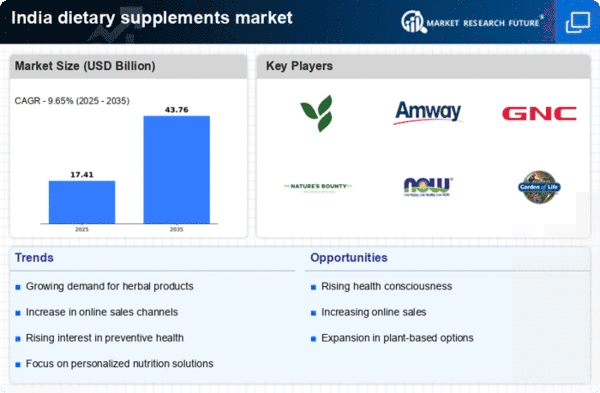

The rapid growth of e-commerce in India is transforming the dietary supplements market. With the increasing penetration of the internet and smartphones, consumers are more inclined to purchase supplements online. E-commerce platforms provide a wide range of products, often at competitive prices, which appeals to a diverse consumer base. Data suggests that online sales of dietary supplements could account for over 30% of total sales by 2026. This shift not only enhances accessibility but also allows consumers to compare products and read reviews, thereby making informed choices. The dietary supplements market is thus adapting to this digital transformation, with brands investing in online marketing strategies.

Influence of Social Media

The role of social media in shaping consumer preferences cannot be overlooked in the dietary supplements market. Influencers and health advocates are increasingly promoting various supplements, which appears to significantly impact purchasing decisions. The dietary supplements market is witnessing a surge in brand collaborations with social media personalities, enhancing visibility and credibility. This trend is particularly pronounced among younger consumers, who are more likely to trust recommendations from online figures. As a result, brands are investing in social media marketing strategies to engage with potential customers, which could lead to increased sales and brand loyalty.

Growing Health Consciousness

The increasing awareness of health and wellness among the Indian population appears to be a primary driver for the dietary supplements market. As consumers become more informed about nutrition and the benefits of dietary supplements, the demand for products that support overall health is likely to rise. Reports indicate that the market is projected to grow at a CAGR of approximately 10% from 2025 to 2030. This trend is particularly evident among urban populations, where lifestyle diseases are prevalent. The dietary supplements market is witnessing a shift towards products that promote immunity, energy, and mental well-being, reflecting a broader societal focus on preventive health measures.

Regulatory Support and Standards

The Indian government's focus on regulating the dietary supplements market is fostering a more structured environment for growth. Recent initiatives aimed at establishing quality standards and safety regulations are likely to enhance consumer trust in dietary supplements. The dietary supplements market is benefiting from these regulatory frameworks, which help to weed out substandard products and promote transparency. As consumers become more aware of quality issues, the demand for certified and compliant products is expected to rise. This regulatory support may also encourage new entrants into the market, further stimulating competition and innovation.