Top Industry Leaders in the India Color Sorter Market

*Disclaimer: List of key companies in no particular order

Top listed global companies in the industry are:

- Satake India Engineering

- Sea

- Fowler Westrup

- Tomra

- Orange

- Buhler Group

- Key Technology

- Hefei Meiya Optoelectronic Technology Inc.

- Anhui Zhongke Optic-electronic Color Sorter Machinery Co. Ltd

- Hefei TAIHE Optoelectronics Technology Co. Ltd., and others.

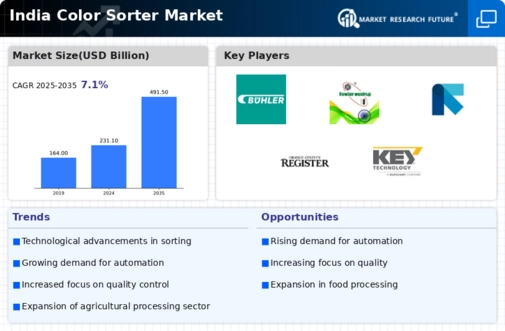

Sorting Out the Competition: A Glance at the Indian Color Sorter Market

The Indian color sorter market is witnessing a colorful competition between domestic and international players. Understanding the strategies adopted by key players, the factors influencing market share, and emerging trends is crucial for navigating this dynamic landscape.

Key Players and their Strategies:

- Established Global Giants: Companies like Bühler Group and Satake Corporation leverage their vast experience, diverse product portfolios, and strong brand recognition to capture a significant market share. Bühler excels in high-capacity sorters for grains and pulses, while Satake caters to niche applications like spices and seeds with specialized solutions.

- Domestic Leaders: Players like EyeTech Digital Systems and Uniklam Technologies capitalize on their local presence, understanding of regional demands, and cost-effective offerings to gain traction. EyeTech focuses on budget-friendly sorters for small and medium-sized businesses, while Uniklam caters to specific needs of the Indian agricultural sector.

- Emerging Innovators: Startups like Auracle Technologies and Innov8 Sorting are disrupting the market with cutting-edge solutions. Auracle focuses on AI-powered sorting algorithms for improved accuracy and efficiency, while Innov8 brings smart features like real-time data analytics and remote monitoring to their sorters.

Factors for Market Share Analysis:

- Technological Capability: Offering advanced sorting technologies like multi-spectral imaging, AI-powered algorithms, and high-resolution cameras empowers players to address diverse sorting needs and ensure precision.

- Industry Expertise: Deep understanding of specific crops, their challenges, and government regulations allows players to tailor solutions and build trust with customers. Uniklam's expertise in sorting Indian pulses is a prime example.

- Cost-Effectiveness and ROI: Balancing advanced features with affordability is crucial, especially in price-sensitive sectors like the Indian agricultural market. EyeTech's cost-effective sorters have fueled its success.

- After-Sales Service and Support: Offering readily available spare parts, prompt technical assistance, and training programs fosters customer loyalty and brand preference. Bühler's extensive service network across India strengthens its market position.

Emerging Trends and Company Strategies:

- Digitalization and Smart Sorting: Integrating sensors, data analytics, and AI into sorters enables real-time performance monitoring, predictive maintenance, and optimized sorting parameters. Auracle's AI-powered sorters exemplify this trend.

- Focus on Food Safety and Hygiene: Stringent regulations and consumer demand for high-quality food are driving the need for advanced sorting technologies that ensure food safety and minimize contamination. Satake's high-precision sorters address this growing demand.

- Localization and Customization: Adapting to local crop varieties, integrating regional language interfaces, and providing customized training programs resonate well with domestic customers. Uniklam's focus on regional customization exemplifies this approach.

- Focus on Niche Applications: Targeting specific high-growth segments like spices, oilseeds, and medicinal herbs with specialized sorting solutions is gaining traction. Innov8's sorters for sorting turmeric and chilies showcase this trend.

Overall Competitive Scenario:

The Indian color sorter market is a vibrant space where established players battle domestic champions and innovative startups for market share. Success hinges on a combination of advanced technology, industry expertise, cost-effectiveness, and robust after-sales support. Embracing digitalization, prioritizing food safety, and offering localized solutions are key factors for differentiation in this dynamic landscape.

Latest Company Updates:

January 2023- A prominent participant supported by the three-decade-long retail history and expertise in redefining the online retail space, Kapsons Retail Private Limited, on January 12th, discovered a mission in presenting the critical stage to small and medium businesses to reinforce their development in the e-commerce circle promising a 0 percent annulment rate, 0.03 percent order defect degree, and 0 percent SLA breach degree.

January 2023- A Brazil-based global vegan personal care brand, Surya Brasil, which entered the Indian market a year back, has announced the upgradation of its product variety with the adding of a refurbished Henna Cream variety, engineered specially for Indian hair and scalp kinds. A leader in the global personal care area, Surya Brasil, has developed an extraordinary range of products– Post-Color Conditioner, Henna Cream Surya Brasil, and Pre-Coloration Shampoo– with better formula and added value to come up with a natural, unique, and easy way to color as well as treat the hair. Believing the prevailing scalp and hair disasters in the region, pushed mainly due to the severe chemicals, the improved shampoo is nearly 96.2 percent natural whereas the conditioner has nearly 98.8 percent natural content. The company is also ready to grow its market footprint in several nations and is at present on the search for extraordinary partners for the distribution of their high-end products at both domestic as well as international levels.