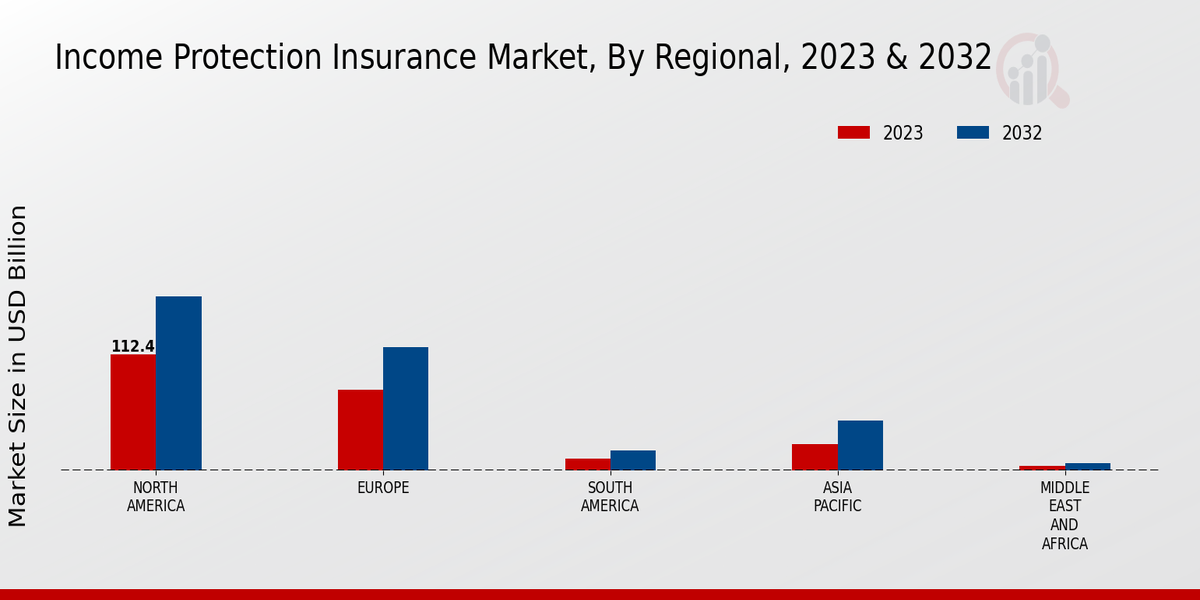

Market Growth Projections

The Global Income Protection Insurance Market Industry is poised for substantial growth, with projections indicating a market size of 235.94 USD Billion in 2024 and an anticipated increase to 541.32 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 7.84% from 2025 to 2035, reflecting the increasing demand for income protection solutions across various demographics. Factors such as rising awareness, workforce participation, and technological advancements are expected to drive this growth, positioning the market as a critical component of the global insurance landscape.

Economic Stability and Growth

Economic stability and growth are pivotal factors influencing the Global Income Protection Insurance Market Industry. As economies strengthen, individuals are more willing to invest in insurance products that provide financial security against unforeseen circumstances. A stable economic environment fosters consumer confidence, leading to increased disposable income and a greater propensity to purchase income protection insurance. This trend is expected to sustain the market's growth trajectory, with forecasts suggesting that the market will expand significantly, reaching 541.32 USD Billion by 2035, as consumers prioritize safeguarding their financial futures.

Growing Workforce Participation

The expanding participation of individuals in the workforce, particularly among women and younger demographics, serves as a significant driver for the Global Income Protection Insurance Market Industry. As more people engage in full-time employment, the need for income protection becomes increasingly apparent. This trend is underscored by statistics showing that a larger workforce correlates with a higher demand for insurance products that safeguard against income loss. Consequently, the market is expected to grow substantially, with projections indicating a rise to 541.32 USD Billion by 2035, reflecting the evolving employment landscape.

Regulatory Support and Incentives

Regulatory frameworks and government incentives play a crucial role in shaping the Global Income Protection Insurance Market Industry. Governments worldwide are increasingly recognizing the importance of income protection insurance in promoting financial resilience among citizens. As a result, various initiatives, such as tax benefits or subsidies for policyholders, are being introduced to encourage the uptake of these products. This supportive regulatory environment is likely to enhance market growth, as more individuals are motivated to secure their income against potential risks, contributing to the overall expansion of the market.

Rising Awareness of Income Protection

The increasing awareness regarding the importance of income protection insurance is a notable driver in the Global Income Protection Insurance Market Industry. As individuals recognize the potential financial risks associated with loss of income due to illness or disability, they are more inclined to seek out income protection policies. This heightened awareness is reflected in the growing number of inquiries and policy purchases, contributing to the market's expansion. The Global Income Protection Insurance Market is projected to reach 235.94 USD Billion in 2024, indicating a robust demand for these products as consumers prioritize financial security.

Technological Advancements in Insurance

Technological innovations are transforming the Global Income Protection Insurance Market Industry by enhancing the efficiency and accessibility of insurance products. Digital platforms facilitate easier policy comparisons, applications, and claims processes, making it more convenient for consumers to obtain income protection insurance. Moreover, advancements in data analytics allow insurers to better assess risk and tailor policies to individual needs. This technological shift is likely to attract a broader customer base, contributing to a projected compound annual growth rate of 7.84% from 2025 to 2035, as more individuals recognize the value of customized insurance solutions.

Leave a Comment