Rising Demand for Personalized Marketing

The growing emphasis on personalized marketing strategies significantly influences the Image Recognition In CPG Market Industry. Brands are increasingly leveraging image recognition to analyze consumer behavior and preferences, allowing for tailored marketing campaigns. By utilizing visual data, companies can identify trends and consumer interests, leading to more effective advertising. As of 2025, it is estimated that personalized marketing can increase conversion rates by up to 20%, highlighting the potential benefits for CPG brands. This trend suggests that image recognition technology will become an essential tool for marketers aiming to enhance customer engagement and drive sales.

Regulatory Compliance and Quality Control

Regulatory compliance and quality control are increasingly important in the Image Recognition In CPG Market Industry. Companies are utilizing image recognition technology to ensure that products meet safety and quality standards. By automating quality checks, businesses can minimize the risk of human error and enhance product consistency. Recent statistics show that firms implementing image recognition for quality control have reduced product recalls by up to 30%. This trend highlights the necessity for CPG companies to adopt advanced technologies to maintain compliance with regulations and uphold brand reputation in a competitive market.

Increased Focus on Supply Chain Efficiency

The need for enhanced supply chain efficiency is a critical driver in the Image Recognition In CPG Market Industry. Companies are adopting image recognition solutions to monitor inventory levels, track shipments, and ensure product quality. By automating these processes, businesses can reduce operational costs and improve accuracy. Recent data indicates that companies utilizing image recognition in their supply chains have experienced a 15% reduction in logistics costs. This trend underscores the importance of integrating advanced technologies into supply chain management, as firms seek to optimize their operations and respond swiftly to market demands.

Growing Adoption of Smart Packaging Solutions

The trend towards smart packaging is reshaping the Image Recognition In CPG Market Industry. Smart packaging incorporates image recognition technology to provide consumers with interactive experiences, such as scanning products for nutritional information or promotional offers. This innovation not only enhances consumer engagement but also allows brands to gather valuable data on consumer interactions. As of 2025, the smart packaging market is projected to grow at a compound annual growth rate of 12%, indicating a strong interest in integrating technology into packaging solutions. This shift suggests that image recognition will play a crucial role in the future of product packaging and consumer interaction.

Technological Advancements in Image Recognition

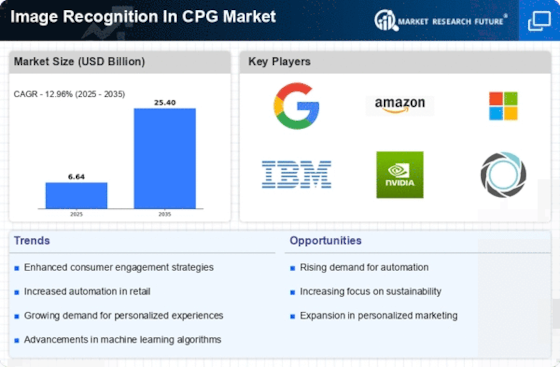

The rapid evolution of image recognition technology plays a pivotal role in the Image Recognition In CPG Market Industry. Innovations in artificial intelligence and machine learning have led to enhanced accuracy and efficiency in image processing. For instance, advancements in deep learning algorithms enable systems to recognize products with greater precision, thereby improving inventory management and reducing errors. As of 2025, the market for image recognition technology is projected to reach approximately 30 billion USD, indicating a robust growth trajectory. This surge is likely driven by the increasing demand for automated solutions in retail and supply chain management, where image recognition can streamline operations and enhance customer experiences.