Market Trends

Introduction

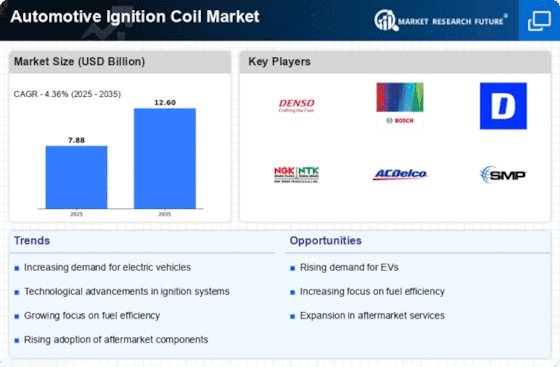

In the years 2024, the world Automotive Ignition Coil Market is going to be an important one. There are many reasons for this. Technological advances, especially in the field of design and materials, are constantly increasing the efficiency and power of ignition coils, thereby contributing to the growing demand for high-power vehicles. Regulations aimed at reducing emissions are forcing manufacturers to adopt new, more sustainable production methods, which in turn will influence the development of products. And the changing tastes of consumers, who are increasingly opting for electric and hybrid vehicles, are influencing the range of applications for the ignition coil. These trends are strategically important for all the players, because they determine their positioning in the market and guide investment and development strategies in a changing environment.

Top Trends

-

Shift Towards Electric Vehicles

The auto industry is rapidly shifting to electric vehicles, which are expected to dominate the market by 2030. The major manufacturers are investing heavily in the development of EVs, and companies like Denso are working on advanced starters for hybrid vehicles. The resulting decline in demand for conventional ignition coils will affect production strategies. The shift to EVs could have a significant impact on the market for coils. -

Integration of Smart Technologies

The integration of smart technology in ignition systems is increasingly becoming commonplace, with companies like Bosch introducing advanced ignition coils to enhance vehicle performance. The smart coils can communicate with onboard diagnostics, which in turn optimizes fuel consumption and reduces emissions. This trend is supported by the tightening of regulations, which is forcing the industry to come up with ever more effective solutions. Consequently, investment in R&D into smart ignition systems is set to rise. -

Focus on Fuel Efficiency

With the rising price of fuel, the efficiency of cars is becoming more important. Some companies, like Delphi, are developing new coils that optimize the combustion process and reduce fuel consumption. According to industry data, a car with an advanced sparking system can save up to 15 percent in fuel consumption. This trend is causing suppliers to enhance their product ranges and may have a significant effect on the industry's strategic direction. -

Sustainability and Eco-Friendly Materials

Towards a sustainable development in the automobile industry, manufacturers are increasingly looking for sustainable materials for the ignition coils. Federal-Mogul is leading the way in reducing the impact of its products on the environment. With governments' stricter regulations, the demand for sustainable components is expected to increase. This trend can lead to closer collaboration between manufacturers and suppliers to develop even more sustainable solutions. -

Growth of Aftermarket Services

Among the after-markets for car parts, the after-market for spark plugs is experiencing considerable growth, as owners of vehicles seek cost-effective solutions for maintaining their cars. As a result, companies such as BorgWarner are expanding their after-market business. Moreover, the after-market for cars is set to grow substantially in the future, and that is why manufacturers are strengthening their distribution network. This trend may result in greater competition among suppliers in the after-market. -

Technological Advancements in Manufacturing

3D printing and automation are revolutionizing the production of the coils. Mitsubishi Electric has begun utilizing these two new production methods to increase efficiency and reduce costs. As these methods become more commonplace, we will see shorter lead times and more diversified products. Eventually, the supply chain will become more responsive to market demands. -

Rising Demand in Emerging Markets

In the emerging markets, especially in the Asia-Pacific region, the production of cars is growing rapidly, which in turn increases the demand for the coils in the ignition system. This is why companies like Wings Automobile Products are expanding their business in this region. The growth in the Asian automobile industry is expected to be significant, and the manufacturers have adapted their strategies accordingly. The trend is that more and more companies will invest in the local production of coils to meet the local demand. -

Enhanced Performance Standards

Since the performance requirements for vehicles are constantly increasing, manufacturers are forced to improve the design of the spark plugs. Hitachi Automotive Systems is a leader in the development of high-performance spark plugs. The company has compiled a great deal of research on the spark plugs. It has found that vehicles with the most advanced spark plugs have the best acceleration and the fastest response. And that this is a trend that will drive development. -

Collaboration and Partnerships

The collaboration between automobile manufacturers and technology companies is becoming more and more common to bring about innovation in spark-ignition systems. Strategic alliances between companies have been forged, as is the case with the close ties between Bosch and the digital start-ups. The trend towards closer collaboration between automobile manufacturers and technology companies is expected to speed up the development of next-generation spark-ignition systems. And as a result of such collaboration, the companies will also be able to pool their resources, which will lead to cost savings and the development of more efficient products. -

Regulatory Compliance and Safety Standards

Governments are imposing stricter safety and emissions standards on the auto ignition coil market. To stay in the game, companies need to meet these regulations. For example, the European Union’s new safety standards are causing manufacturers to invest in compliance-related technology. This trend may lead to higher operating costs but also opens up opportunities for innovation in safety features.

Conclusion: Navigating the Competitive Landscape Ahead

The market for the ignition coils for cars will be very competitive and fragmented in 2024, with many players emerging. The trend towards a more sustainable and technologically advanced product will push the market to innovation. Brands and distribution networks of the old players will be a source of differentiation, while the new entrants will focus on agility and the use of new technology such as artificial intelligence and automation. Adaptability and integration of sustainable practices will be the main factors of success in this changing market. It will be necessary to strengthen these skills to face the complexity of the market and to seize the opportunities that will arise.

Leave a Comment