Market Trends

Key Emerging Trends in the Iceland Sustainable Chemicals Market

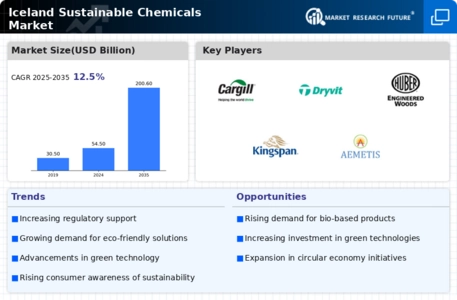

Currently, there are notable trends within the Iceland Sustainable Chemicals Market that point towards an increased emphasis on green practices. Global concerns over climate change and environmental degradation have led industries worldwide to evaluate their production processes as well as materials so that they fit within sustainable frameworks. One major trend in Iceland's Sustainable Chemicals Market is the rising demand for bio-based chemicals. Currently, both consumers and firms appreciate that reliance on fossil fuels along with petrochemicals has negative implications; hence, alternative energy sources like biofuels have been developed. The bio-based chemicals made from biomass renewable sources or waste products from farming or microorganisms offer a better option that is more environmentally friendly compared to other sources, which could cause damage to our environment in the future days ahead when we would be in need of these resources apart from looking at it as a question of being green simply due to environmental reasons. Additionally, there has been a marked increase in investment and research conducted on green chemistry within the Icelandic market area. Green chemistry refers to the design and development of chemical products along with processes that either minimize or even eliminate their negative impacts on living organisms. By employing green chemistry principles in the production of chemicals, waste generation is reduced, energy consumption decreases, and safer raw materials are used. Furthermore, circular economy principles are gaining traction in the Iceland Sustainable Chemicals Market. This is because the traditional model of linear production-consumption-disposal is gradually being replaced by a concept that emphasizes recycling, reuse, and reduction of waste. The ultimate aim for many companies in Iceland is to close the loop in their chemical production processes by designing products that can be easily recycled or repurposed. In addition to being aligned with sustainability goals, this contributes to a more resource-efficient and resilient economy. Furthermore, there has been an increasing demand for sustainable packaging solutions within the market space. Consumers have become aware of their environmental footprints, thereby leading them to a quest for eco-friendly packaging materials. Some Icelandic chemical corporations are considering alternative packaging materials such as biodegradable plastic or using recycled materials when creating package items like boxes or bags, among others. Finally, regulatory initiatives and governmental support significantly shape market trends within Iceland’s sustainable chemicals industry. Specifically, policies introduced by governments that either mandate or provide incentives towards the adoption of sustainable practices along with the use of environmentally friendly inputs help businesses choose what best suits their operations without contravening environmental management guidelines. Nevertheless, this supportive regulation ensures compliance with environmental standards while fostering innovation and investment in sustainable technologies at large.

Leave a Comment