Top Industry Leaders in the Hydropower Turbine Market

*Disclaimer: List of key companies in no particular order

Latest Company Updates:

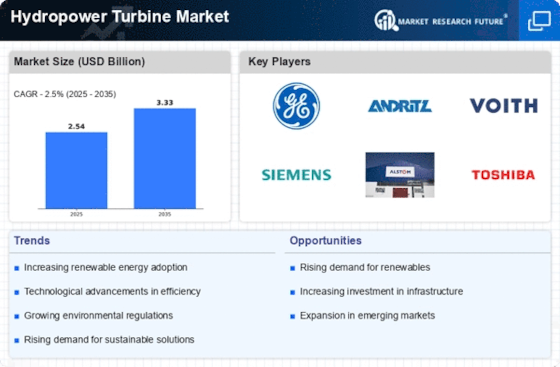

The Hydropower Turbine Market: Navigating Currents of Competition

The hydropower turbine market, despite facing headwinds from renewable energy rivals, remains a resilient force, driven by an unwavering commitment to clean energy and ongoing technological advancements. Understanding the competitive landscape requires a deep dive into the strategies employed by key players, the factors shaping market share dynamics, and emerging trends that are reshaping the industry.

Giants Commanding the Flow: Established players like Voith, Andritz, GE Renewable Energy, and Siemens Gamesa Renewable Energy hold a dominant position, leveraging their extensive experience, global reach, and robust portfolios encompassing diverse turbine types and capacities. These companies prioritize efficient manufacturing, optimized designs, and comprehensive aftermarket services to secure repeat business and solidify customer loyalty. Their strategic acquisitions of smaller players and partnerships with technology providers further bolster their market presence.

Navigating the Niche: Smaller players carve out unique niches by specializing in specific turbine types like Kaplan or Pelton turbines, catering to micro-hydro or off-grid applications, or focusing on emerging markets with specific needs. Companies like Francis Turbines Inc. and ENERCON excel in smaller-scale projects, while others like TNEI and Xylem focus on customized solutions for challenging environments. These niche players rely on agility, innovation, and cost-effectiveness to compete against larger rivals.

Sharpening the Competitive Edge: To maintain their positions, leading players are actively pursuing:

Technological Advancements: Investing in R&D to improve turbine efficiency, reliability, and operational adaptability to fluctuating water flows.

Sustainable Solutions: Developing eco-friendly materials and processes to minimize environmental impact, attracting environmentally conscious clients.

Digital Transformation: Integrating advanced sensors, data analytics, and AI into turbines for intelligent control and predictive maintenance.

Expanding Service Offerings: Providing comprehensive lifecycle management solutions, including financing, installation, operation, and maintenance, to build long-term partnerships with clients.

Market Share: Beyond Size: When analyzing market share, it's crucial to look beyond just turbine capacity. Factors like geographical reach, project type expertise (run-of-the-river vs. pumped storage), and service capabilities come into play. Emerging markets like China and India are witnessing a surge in hydropower projects, presenting lucrative opportunities for players with strong regional presence and expertise in adapting to local conditions.

Emerging Trends: Reshaping the Future:

Modular Turbines: Prefabricated, easily deployable modular turbines are gaining traction, especially for remote locations and off-grid applications.

Hybrid Power Systems: Integrating hydropower with other renewable energy sources like solar or wind is becoming increasingly common, offering greater flexibility and resilience in power generation.

Hydropower Repowering: Modernizing existing hydropower facilities with newer, more efficient turbines is extending their lifespan and boosting output.

The Current: A Turbulent Yet Promising Outlook:

While the hydropower turbine market faces competition from other renewable energy sources and challenges like environmental concerns and social impact assessments, its long-term outlook remains positive. The growing global demand for clean energy, coupled with technological advancements and strategic responses from key players, will continue to propel the market forward. Understanding the competitive landscape, identifying niche opportunities, and embracing emerging trends will be crucial for navigating the turbulent currents and securing a strong position in this dynamic market.

General Electric:

• October 26, 2023: GE Renewable Energy announced a contract with Statkraft to supply two Francis turbines for the 412 MW Holen 2 hydropower project in Norway. (Source: GE Renewable Energy press release)

Andritz:

• December 6, 2023: Andritz received an order from Hydro-Québec for the complete electromechanical equipment for the 51 MW La Romaine 4 hydropower project in Canada. (Source: Andritz press release)

Toshiba Energy:

• October 24, 2023: Toshiba Energy and Mitsubishi Heavy Industries signed a joint venture agreement to establish a new company for hydropower engineering and services. (Source: Toshiba Energy press release)

Kirloskar Brothers Ltd:

• November 8, 2023: Kirloskar Brothers secured an order from Nepal Electricity Authority for three vertical Kaplan turbines for the 14 MW Trishuli HEP project. (Source: Kirloskar Brothers press release)

Top listed global companies in the industry are:

General Electric

Andritz

Toshiba Energy

Kirloskar Brothers Ltd,

Siemens

Canyon Industries Inc.

Hitachi Ltd.

Cornell Pump Co.

Canadian Hydro

Components Ltd

WWS Wasserkraft GmbH

Capstone Turbine

Gilbert Gilkes & Gordon