Rising Health Consciousness

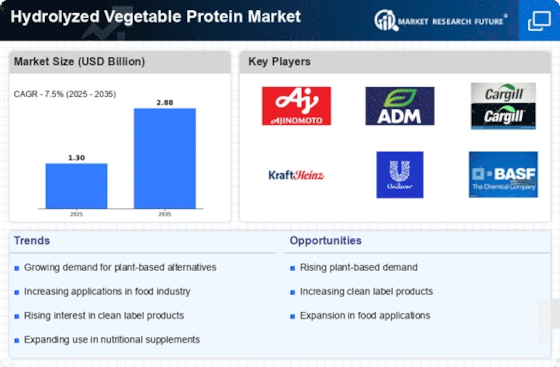

The Hydrolyzed Vegetable Protein Market is experiencing a surge in demand driven by increasing health consciousness among consumers. As individuals become more aware of the nutritional benefits associated with plant-based proteins, the market is likely to expand. Hydrolyzed vegetable proteins are recognized for their high digestibility and amino acid profile, making them appealing to health-focused consumers. According to recent data, the plant-based protein sector is projected to grow at a compound annual growth rate of approximately 8% over the next five years. This trend suggests that the Hydrolyzed Vegetable Protein Market could see substantial growth as more consumers seek healthier dietary options.

Expansion of Vegan and Vegetarian Diets

The Hydrolyzed Vegetable Protein Market is poised for growth as the adoption of vegan and vegetarian diets continues to rise. With a growing number of individuals opting for plant-based lifestyles, the demand for alternative protein sources is increasing. Hydrolyzed vegetable proteins serve as a versatile ingredient in various food products, catering to this expanding demographic. Market analysis indicates that the plant-based food market is expected to reach a valuation of over 74 billion by 2027, highlighting the potential for hydrolyzed vegetable proteins to play a significant role in this transformation. This shift in dietary preferences is likely to bolster the Hydrolyzed Vegetable Protein Market.

Growing Demand for Clean Label Products

The Hydrolyzed Vegetable Protein Market is witnessing a growing demand for clean label products, as consumers increasingly prefer transparency in food ingredients. Hydrolyzed vegetable proteins, often perceived as natural and minimally processed, align well with this trend. As consumers seek products with fewer artificial additives, the market for clean label ingredients is expanding. Recent studies suggest that nearly 60% of consumers are willing to pay more for products that are labeled as clean. This shift in consumer preferences indicates that the Hydrolyzed Vegetable Protein Market could see increased sales as manufacturers respond to the demand for cleaner, more transparent ingredient lists.

Technological Advancements in Protein Processing

Technological advancements in protein processing are significantly influencing the Hydrolyzed Vegetable Protein Market. Innovations in extraction and hydrolysis techniques enhance the quality and functionality of vegetable proteins, making them more appealing to food manufacturers. These advancements not only improve the nutritional profile of hydrolyzed vegetable proteins but also expand their applications in various food products, including snacks, sauces, and meat alternatives. The market for food processing technology is projected to grow, indicating that the Hydrolyzed Vegetable Protein Market could benefit from these developments. Enhanced processing methods may lead to increased product offerings and improved consumer acceptance.

Increased Application in Food and Beverage Sector

The Hydrolyzed Vegetable Protein Market is benefiting from increased applications in the food and beverage sector. As manufacturers seek to enhance flavor profiles and nutritional content, hydrolyzed vegetable proteins are being incorporated into a variety of products, including soups, sauces, and snacks. The versatility of these proteins allows for their use in both savory and sweet applications, broadening their market appeal. Market Research Future indicates that the food and beverage industry is projected to grow significantly, which may further drive the demand for hydrolyzed vegetable proteins. This trend suggests a promising future for the Hydrolyzed Vegetable Protein Market as it adapts to evolving consumer preferences.