Supportive Regulatory Frameworks

The Hydrogen Hubs Market is significantly influenced by supportive regulatory frameworks established by governments worldwide. Policies aimed at promoting hydrogen as a clean energy source are being implemented, which include subsidies, tax incentives, and research funding. For example, several countries have introduced hydrogen strategies that outline ambitious targets for hydrogen production and consumption. These frameworks are designed to stimulate investment in hydrogen infrastructure and technology, thereby fostering the growth of the Hydrogen Hubs Market. The alignment of regulatory support with market needs is expected to create a conducive environment for the establishment of hydrogen hubs, facilitating collaboration between public and private sectors. As these policies evolve, they are likely to enhance the attractiveness of hydrogen as a viable energy solution.

Investment in Research and Development

Investment in research and development is a crucial driver for the Hydrogen Hubs Market. As the demand for hydrogen solutions grows, so does the need for innovative technologies and processes. Governments and private entities are allocating substantial funds towards R&D initiatives aimed at improving hydrogen production, storage, and distribution methods. Recent reports indicate that R&D investments in hydrogen technologies could exceed USD 10 billion annually by 2030. This influx of funding is expected to accelerate technological advancements, making hydrogen hubs more efficient and cost-effective. Furthermore, collaboration between academia, industry, and government entities is likely to foster innovation, leading to breakthroughs that could transform the Hydrogen Hubs Market. As R&D efforts continue to expand, they will play a vital role in shaping the future landscape of hydrogen energy.

Growing Interest from Industrial Sectors

The Hydrogen Hubs Market is witnessing increasing interest from various industrial sectors, particularly those with high energy demands. Industries such as steel, chemicals, and transportation are exploring hydrogen as a means to decarbonize their operations. For instance, the steel industry is projected to account for a significant portion of hydrogen demand, with estimates suggesting that hydrogen could replace up to 30% of traditional fossil fuels used in steel production by 2030. This shift not only aligns with sustainability goals but also enhances energy security for these sectors. The growing interest from industries is likely to drive the establishment of hydrogen hubs, as companies seek to collaborate on infrastructure development and share resources. Consequently, the Hydrogen Hubs Market stands to benefit from this trend, as industrial players increasingly recognize the potential of hydrogen in their energy strategies.

Rising Demand for Clean Energy Solutions

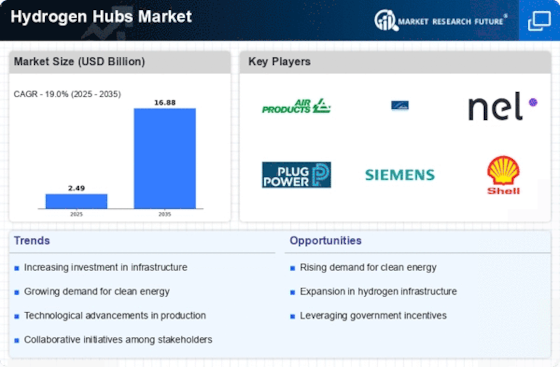

The Hydrogen Hubs Market is experiencing a notable surge in demand for clean energy solutions. As nations strive to meet their climate goals, the transition from fossil fuels to hydrogen as a clean energy carrier is becoming increasingly critical. According to recent data, the hydrogen market is projected to reach a value of approximately USD 200 billion by 2030, driven by the need for sustainable energy sources. This shift is not merely a trend but a fundamental change in energy consumption patterns, as industries and governments recognize the potential of hydrogen hubs to facilitate this transition. The Hydrogen Hubs Market is thus positioned to benefit from this growing demand, as investments in hydrogen infrastructure and technology are likely to increase, fostering a more sustainable energy landscape.

Technological Innovations in Hydrogen Production

Technological advancements play a pivotal role in shaping the Hydrogen Hubs Market. Innovations in hydrogen production methods, such as electrolysis and steam methane reforming, are enhancing efficiency and reducing costs. For instance, advancements in electrolyzer technology have led to a significant decrease in the cost of green hydrogen production, making it more competitive with traditional energy sources. The market for electrolyzers is expected to grow substantially, with estimates suggesting a compound annual growth rate of over 20% in the coming years. These technological innovations not only improve the feasibility of hydrogen hubs but also attract investments, thereby accelerating the development of the Hydrogen Hubs Market. As these technologies mature, they are likely to create new opportunities for stakeholders across the hydrogen value chain.