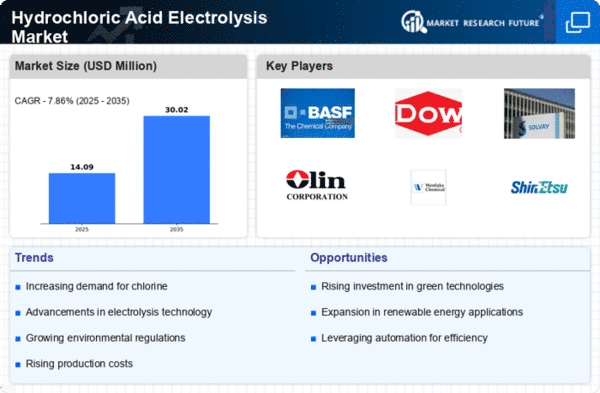

Market Share

Hydrochloric Acid Electrolysis Market Share Analysis

Replacement of Mercury Cell Plants

The global chlor-alkali industry is gradually moving away from using mercury cell technology. This shift is a result of the UN Environment Minamata Convention on Mercury, a global agreement aimed at safeguarding human health and the environment from the harmful effects of mercury. Euro-Chlor notes that European chlor-alkali producers utilizing mercury technology must either convert or dismantle their mercury production plants by 2020. In 2016, mercury technology represented 17.4% of EU chlorine production capacity, whereas membrane production accounted for 66%. Many other regions are expected to follow suit in phasing out mercury cell technology. The chlor-alkali industry is actively seeking safe and cost-effective solutions for chlorine generation processes that are both environmentally sustainable and economically viable to meet the necessary capacity. The eventual discontinuation of mercury cell plants is anticipated to drive the adoption of various HCl electrolysis methods.

ODC Electrolysis was the leading market contributor in 2016, holding the largest share of 28.70% with a market value of USD 358.0 million. It is expected to maintain its growth momentum and achieve the highest Compound Annual Growth Rate (CAGR) of 7.34% during the forecast period. DuPont gas phase electrolysis secured the second-largest position in the market in 2016, valued at USD 294.4 million, and is projected to grow at a CAGR of 4.80%.

In terms of application, PVC Production & Chlorination dominated the market with the largest share of 30.20% in 2016, having a market value of USD 376.7 million. This segment is anticipated to continue its robust growth, with the highest CAGR of 5.49% during the forecast period. The Polyurethane Industry held the second-largest position in 2016, with a market value of USD 311.0 million, and is projected to grow at a CAGR of 4.95%.

Leave a Comment