Top Industry Leaders in the Hydraulic Equipment Market

*Disclaimer: List of key companies in no particular order

The Hydraulic Machinery Sector A Thorough Examination of the Competitive Terrain

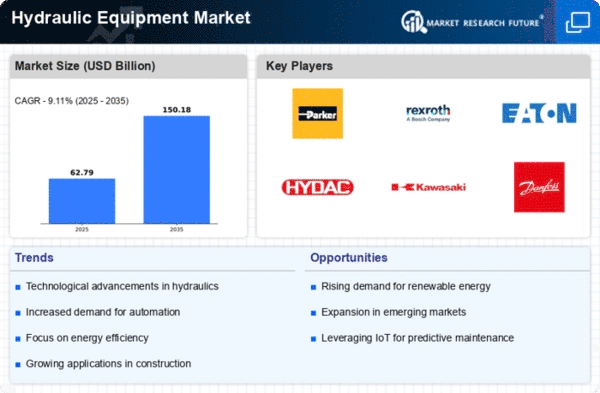

In the realm of global hydraulic machinery, a consistent surge is propelled by factors such as escalating demand for intricate apparatus in diverse sectors, technological strides, and heightened investments in infrastructure. Nevertheless, the landscape is anything but uniform, marked by intense rivalry between entrenched entities and newcomers striving to carve out their market slice.

Principal Participants and Their Approaches:

- Bosch Rexroth (Germany)

- Eaton Corporation Plc (Ireland)

- Parker Hannifin (US)

- Kawasaki (Japan)

- HAWE (Germany)

- Hydac (Germany)

- Moog, Inc. (US)

- Bucker Hydraulics (Germany)

- Daikin (Japan)

- Concentric (Sweden)

- Casappa (Italy)

- Nachi-Fujikoshi (Japan)

- Dantal Hydraulics (India)

- Fluitronics GmbH (Germany)

- Linde Hydraulics (Germany), and others.

- Global Titans:

Esteemed entities like Bosch Rexroth, Parker Hannifin, Eaton, and Kawasaki Heavy Industries wield dominance, boasting diverse product portfolios, well-established distribution networks, and robust brand recognition. Their game plan revolves around ceaseless innovation, strategic acquisitions, and venturing into burgeoning sectors like mobile hydraulics and energy-efficient solutions.

- Regional Contenders:

Enterprises such as HYDAC International, Aichi Machine Industry, and Tong Yang Group are etching out niches in specific regions and product segments. They exploit their cost efficiency, agility, and profound comprehension of local markets to meet regional demands effectively.

- Up-and-Coming Players:

Startups and technology-centric firms are infiltrating the market with ingenious solutions, including intelligent hydraulic systems, AI-fueled predictive maintenance, and bio-derived hydraulic fluids. These players center their focus on revolutionary technologies to address environmental apprehensions and operational inefficiencies.

Aspects for Scrutinizing Market Share:

Product Spectrum: The expansiveness and profundity of product offerings across segments like pumps, valves, cylinders, and actuators are pivotal. Entities with an exhaustive range cater to diverse consumer needs, securing an advantage over specialized counterparts.

Geographic Footprint: A robust regional presence through manufacturing facilities and distribution networks is indispensable for seizing market shares in pivotal geographies. Asia-Pacific, fueled by the infrastructure boom in China and India, emerges as a major battleground.

Technological Ingenuity: Unceasing investments in Research and Development (R&D) to craft energy-efficient, compact, and intelligent hydraulic systems stand as the crux of differentiation, alluring customers seeking cutting-edge solutions.

Brand Esteem and Standing: A robust brand image built on reliability, quality, and customer service nurtures trust and loyalty, resulting in repeat business and an expansion of market shares.

Pricing Tactics: Striking a balance between competitive pricing, cost efficiency, and profitability is imperative. While cost-conscious regions like Asia favor aggressive pricing, premium markets demand value-added services and technological advancements.

Novel and Emerging Trends:

Electrification: The momentum is shifting towards electric vehicles and hybrid hydraulic systems. Enterprises are formulating electro-hydraulic pumps and actuators to enhance efficiency and curtail emissions.

Digitalization: The amalgamation of sensors, data analytics, and AI into hydraulic systems facilitates predictive maintenance, remote monitoring, and real-time optimization, enhancing operational efficiency and uptime.

Sustainable Solutions: Biodegradable hydraulic fluids and energy-efficient systems are gaining momentum amid escalating environmental apprehensions. Companies are channeling investments into eco-friendly technologies to cater to this burgeoning demand.

Overall Landscape of Competition:

The hydraulic machinery market is marked by cutthroat competition, with established entities grappling against regional and burgeoning players. Innovation, technological leaps, and a steadfast focus on sustainability emerge as pivotal distinguishing factors in this dynamic terrain. Entities must tailor their strategies to cater to diverse consumer needs, embrace digitalization and sustainable practices, and strike a balance between cost competitiveness and value-added solutions to thrive in the imminent years.

A comprehensive grasp of these factors and trends equips companies to make judicious strategic decisions, fine-tune their offerings, and seize a noteworthy chunk of this perpetually evolving market.

Developments and Recent Updates in the Industry:

-

Hydac (Germany): Pivots towards high-precision mobile hydraulics, recently forging collaboration with Liebherr for excavators. -

Moog, Inc. (US): Renowned for high-performance servo valves, expanding its domain into electrohydraulic and digital solutions. -

Bucker Hydraulics (Germany): Specializing in compact hydraulic cylinders, announced the inauguration of a new production facility in the US in 2023. -

Daikin (Japan): Exhibiting strength in hydraulic components for construction and agricultural machinery, partnered with Bosch Rexroth on specific projects. -

Concentric (Sweden): Pioneering in hydraulic steering systems, extending its reach into electric power steering solutions.