Top Industry Leaders in the Hybrid Vehicle Market

*Disclaimer: List of key companies in no particular order

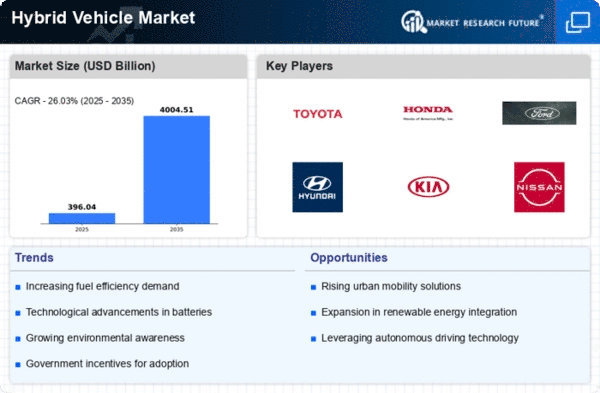

The hybrid vehicle market, a bridge between fossil fuels and full electrification, is buzzing with competitive energy. Established players face off against disruptive innovators, all vying for a slice of this rapidly growing pie. Understanding the strategies, trends, and players shaping this dynamic landscape is crucial for navigating the market effectively.

Top Companies in the Hybrid Vehicle industry includes,

Toyota Motor Company

Honda Motor Company

BYD Company Ltd

Lexus

Ford Motor Company

Kia Motors Company

Nissan Motor Company

Volkswagen AG

AB Volvo, and others.

Key Player Strategies:

Traditional Titans: Toyota, Honda, and Hyundai leverage their extensive experience, well-established production lines, and brand recognition to maintain their dominance. They prioritize fuel efficiency, affordability, and reliability, catering to mass-market customers seeking a fuel-conscious option. Toyota's Prius, a pioneer in the field, continues to lead the hybrid segment.

Global Giants: Volkswagen, General Motors, and Ford are aggressively expanding their hybrid offerings, leveraging their global reach and diverse portfolios. They combine hybrid technology with their existing platforms, offering familiar driving experiences and established service networks. Volkswagen's ID. family of vehicles includes both full BEVs and hybrid variants, showcasing their commitment to offering both options.

Tech-Savvy Challengers: Companies like Tesla and Rivian are disrupting the market with innovative plug-in hybrid (PHEV) technologies, extended electric ranges, and cutting-edge software features. They cater to tech-savvy early adopters seeking performance and connectivity in addition to fuel efficiency. Tesla's Model S PHEV pushes the boundaries of hybrid performance, attracting a premium segment.

Regional Champions: BYD and Geely are making waves in their domestic markets with cost-effective hybrids, leveraging strong local partnerships and understanding of regional preferences. They offer affordable options, catering to budget-conscious consumers in emerging markets. BYD's DM-i hybrids stand out for their efficiency and competitive pricing.

Factors for Market Share Analysis:

Fuel Efficiency and Performance: Balancing efficient electric motors with powerful gasoline engines is crucial for achieving optimal fuel savings and attracting performance-oriented customers. Companies with superior hybrid powertrains gain an edge.

Driving Range and Charge Capability: PHEVs with longer electric ranges and faster charging times offer greater flexibility and appeal to urban drivers. Companies leading in these areas cater to range anxiety and encourage wider adoption.

Cost and Affordability: Balancing innovative technology with competitive pricing is essential for driving mass adoption. Companies offering feature-rich hybrids at attainable prices stand out in the face of rising fuel costs.

Government Incentives and Policy: Tax breaks, subsidies, and dedicated infrastructure investments by governments significantly impact market growth. Companies aligning their offerings with policy incentives gain additional traction.

New and Emerging Trends:

Electrification Dominance: As battery technology improves and EV charging infrastructure expands, PHEVs are expected to evolve towards longer electric ranges, blurring the lines between PHEVs and BEVs. Companies investing in advanced PHEV technology anticipate this shift.

Personalization and Connectivity: Advanced onboard diagnostics, smartphone integration, and personalized driving modes are becoming increasingly sought-after features. Companies offering advanced connected car experiences attract tech-savvy consumers.

Focus on Sustainability: Utilizing sustainable materials, reducing carbon footprint throughout the production chain, and promoting responsible battery recycling are gaining traction. Companies demonstrating environmental consciousness attract eco-conscious customers.

Subscription Models and Shared Mobility: Flexible ownership models like hybrid car subscriptions and car-sharing platforms are emerging, particularly in urban areas. Companies embracing these models tap into new consumer segments.

Overall Competitive Scenario:

The hybrid vehicle market is a dynamic space brimming with competitive energy. Established players maintain their position with experience and brand recognition, while tech-savvy challengers disrupt with innovative technologies and features. Regional champions cater to specific markets, and policymakers play a crucial role in influencing growth. Balancing fuel efficiency with performance, affordability, and range will be key for success. As the market evolves towards greater electrification and connectivity, companies embracing innovation, sustainability, and flexible ownership models are poised to lead the charge in this electrifying race.

Industry Developments and Latest Updates:

BYD Company Ltd:

- BYD becomes world's largest EV maker in 2023: BYD surpassed Tesla to become the world's largest electric vehicle maker in 2023. The company sold over 1.8 million EVs in the first 11 months of the year, compared to Tesla's 1.3 million. (Source: Bloomberg)

Ford Motor Company:

- Ford plans to invest $50 billion in EVs by 2026: Ford has announced plans to invest $50 billion in electric vehicles by 2026. The company plans to launch 15 new EVs globally by 2025, including two new EVs in North America. (Source: Ford Motor Company)

Kia Motors Company:

- Kia plans to launch seven new EVs by 2027: Kia has announced plans to launch seven new electric vehicles globally by 2027. The company plans to introduce two new EVs in North America by 2025. (Source: Kia Motors Company)

Nissan Motor Company:

- Nissan Ariya SUV launched in India: Nissan launched its Ariya electric