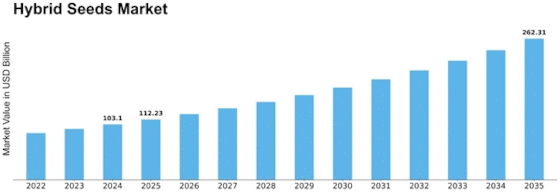

Hybrid Seeds Size

Hybrid Seeds Market Growth Projections and Opportunities

The global Seed Treatment Market is segmented into two main types: chemical and non-chemical. Further divisions under non-chemical include biological and physical treatments. In 2018, the chemical segment held the larger share of the market, accounting for about 77.66%. Over the forecast period, this segment is expected to continue its growth trajectory, projected to register a Compound Annual Growth Rate (CAGR) of 9.88%. Meanwhile, the non-chemical segment, comprising biological and physical treatments, is anticipated to exhibit an even higher CAGR of 10.87% during the review period.

The chemical segment in the Seed Treatment Market holds the major share due to its historical significance and widespread use. It has been the traditional method used by farmers for protecting seeds and ensuring better crop yields. With its proven effectiveness over time, it has garnered a significant market share. Despite its dominance, the non-chemical segment is witnessing faster growth, particularly the biological and physical treatments.

The non-chemical segment, including biological and physical treatments, is gaining traction due to the rising awareness about sustainable agricultural practices. Farmers are increasingly opting for non-chemical treatments as they seek eco-friendly alternatives that minimize harm to the environment and human health. This segment is growing at a faster pace, showcasing a higher CAGR compared to the chemical segment. The shift toward non-chemical treatments is driven by concerns about the long-term impact of chemical treatments on soil fertility, water quality, and overall ecosystem health.

Biological treatments, a subset of non-chemical methods, involve using living organisms like bacteria, fungi, or other natural materials to protect seeds and enhance plant growth. Physical treatments, another category within the non-chemical segment, involve processes such as heat treatment or seed coatings without using any chemicals. These approaches are gaining attention as they offer sustainable alternatives to traditional chemical treatments.

The projected higher CAGR for the non-chemical segment indicates a growing preference among farmers for eco-friendly and sustainable seed treatment options. As environmental concerns continue to rise and regulatory pressures for reducing chemical usage increase, the demand for non-chemical treatments is expected to escalate further.

In conclusion, while the chemical segment maintains a dominant position in the Seed Treatment Market, the non-chemical segment, particularly biological and physical treatments, is rapidly growing. The higher projected CAGR for non-chemical treatments reflects a shifting trend toward eco-friendly and sustainable agricultural practices. As the demand for environmentally conscious solutions rises, non-chemical treatments are poised to witness substantial growth in the seed treatment market.

Leave a Comment