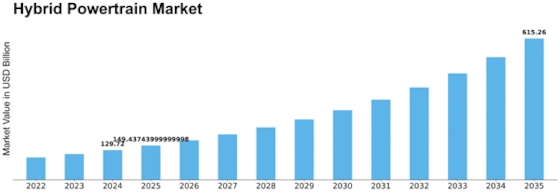

Hybrid Powertrain Size

Hybrid Powertrain Market Growth Projections and Opportunities

The hybrid powertrain market is influenced by a myriad of factors, spanning technological advancements, regulatory policies, consumer preferences, and economic conditions. Technological innovation plays a crucial role in shaping the dynamics of this market. Continuous research and development efforts by automakers and technology companies lead to the introduction of more efficient and sophisticated hybrid powertrain systems. These advancements often result in improved fuel efficiency, reduced emissions, and enhanced performance, driving consumer interest and adoption.

Regulatory policies also exert significant influence on the hybrid powertrain market. Stringent emissions standards imposed by governments around the world compel automakers to explore alternative propulsion systems like hybrids to meet regulatory requirements. Incentives such as tax credits, subsidies, and rebates further encourage consumers to opt for hybrid vehicles, boosting market demand. Conversely, changes in regulations, such as shifts in fuel economy standards or emission targets, can impact the market landscape and influence manufacturers' strategies.

Consumer preferences and behavior play a pivotal role in shaping the market for hybrid powertrains. Growing environmental consciousness among consumers drives demand for eco-friendly transportation options, leading to increased interest in hybrid vehicles. Factors such as fuel prices, maintenance costs, and driving habits also influence consumer decisions regarding hybrid adoption. Additionally, evolving lifestyle trends, such as urbanization and a focus on sustainability, contribute to the demand for hybrid vehicles, especially in densely populated areas where pollution and congestion are significant concerns.

Economic conditions, including fuel prices and overall economic stability, impact the hybrid powertrain market as well. Fluctuations in fuel prices can influence consumers' willingness to invest in hybrid vehicles, as higher fuel costs make fuel-efficient options more appealing. Economic downturns may affect consumer purchasing power and lead to shifts in vehicle preferences, potentially impacting hybrid sales. Conversely, economic recovery and growth can stimulate consumer spending and drive demand for hybrid vehicles as people seek more efficient and cost-effective transportation solutions.

Infrastructure development is another crucial factor in the growth of the hybrid powertrain market. The availability of charging stations for plug-in hybrids and infrastructure support for other hybrid technologies, such as regenerative braking systems, can significantly impact consumer confidence and adoption rates. Governments and private entities investing in charging infrastructure and promoting alternative fuel infrastructure development can accelerate the market's growth by addressing range anxiety and convenience concerns associated with hybrid vehicles.

Competitive dynamics within the automotive industry also shape the hybrid powertrain market. Intense competition among automakers leads to innovation and product differentiation, driving advancements in hybrid technology and expanding the range of hybrid vehicle options available to consumers. Strategic alliances, partnerships, and mergers within the industry can also influence market dynamics, shaping the competitive landscape and impacting the availability and pricing of hybrid vehicles.

In conclusion, the hybrid powertrain market is influenced by a complex interplay of market factors, including technological advancements, regulatory policies, consumer preferences, economic conditions, infrastructure development, and competitive dynamics. Understanding these factors and their interactions is crucial for stakeholders in the automotive industry to anticipate market trends, develop effective strategies, and capitalize on opportunities for growth in the evolving market for hybrid powertrains.

Leave a Comment